Welcome to the home insurance guide for Burnaby. In this page, we will give an overview of British Columbia’s home insurance premiums, as well as provide information about savings opportunities and useful tips for seeking out insurers in Burnaby, BC.

What are typical Home Insurance cost in Burnaby?

The average renters and homeowners insurance premiums in British Columbia (including Burnaby) and other provinces are outlined in this chart. Renters insurance rates are typically lower than the rates for homeowners since renters insurance only covers your personal effects in the rented property and sometimes liability, but not the building itself. The building is covered under homeowners insurance.

Home insurance premiums in British Columbia tend to be higher for a number of reasons:

Earthquake protection: British Columbia is subject to seismic activity from the Pacific. Homeowners can purchase additional protection known as riders. These earthquake riders are particularly important in coastal regions.

High rebuilding costs: The high share of more expensive real estate tends to have a downstream effect on insurance premiums. Though rebuilding costs – as opposed to a property’s market value – drives up home insurance, British Columbia has a higher share of more expensive, high-demand properties, whose rebuild costs rise as a result. These structures are often more complicated than most homes covered by insurance because they must be built to withstand seismic hazards (e.g. lateral bracing requirements and special structuring).

How to save on Home Insurance in Burnaby: 10 Tips

- Earthquake insurance coverage: Living outside of an earthquake zone shouldn’t cause you worry, but if you do live where earthquakes are frequent, earthquake protection can save you money in the event of a seismic event. This protection can be purchased separately as a rider on your existing policy.

- Annual reviews: As your life and your needs change annually, so will your coverage, so be sure to review your policy every year to see where adjustments and potential savings can be made.

- Annual vs. monthly payments: Insurers save on time, postage and billing when you pay yearly. They extend those savings with lower premiums for those that pay for their insurance annually instead of monthly.

- Claims-free discount: Not filing a claim can get you rewarded with savings, although not all insurers offer this discount. Check with your provider for their terms and conditions.

- Renovations: You can save on home insurance premiums by taking the initiative to renovate. Home insurance premiums for older homes that are poorly maintained will usually be higher. Even only a partial renovation, such as to your basement or kitchen, may lead to savings on your policy.

- Heating: Because of the reduced risk, insurers find electric heat or forced-air gas furnaces preferable to oil-heating. Keep this in mind when house-hunting – oil heating can result in higher premiums.

- Plumbing insulation: All pipes, no matter how new, are prone to compromise and bursting if temperatures dip low, so you can reduce or avoid claims by ensuring your pipes are insulated.

- Water damages: Water damage, especially hidden water damage, has potential to cause ongoing maintenance and health issues. Before purchasing a house, have an inspector conduct a thorough search for damage, and learn if there has been water damage in the past.

- Neighbourhood: Living in a low-crime neighbourhood will be good for your safety and helps to keep your premiums low.

- Repair instead claims: Before filing a claim, consider if the cost of the deductible is worth paying to declare a damaged item. Sometimes it is cheaper to repair the item on your own than to file a claim.

5 Elements that will increase your Home Insurance costs

- Business property: Due to the increased risks involved with the goods associated with business and the potential for clientele to visit your home, insurance policies for properties with home based businesses are usually higher because they must account for lost or damaged personal and business contents, and increased liability.

- Fireplace / woodstove: Woodstoves and fireplaces always carry the potential for fire and smoke damage. Having one means that you will likely need a home inspection prior to taking out a policy, and that additional premiums may be added.

- Galvanized or lead pipes: Older homes were routinely outfitted with galvanized or lead pipes until their installation stopped in the seventies. Homes that still have these piping systems are particularly at risk for age-related corrosion, leading to water quality and water pressure concerns. These concerns warrant charging a higher premium.

- Basement: Basements tend to flood when water entry is a problem, which drives up the cost of premiums since burst pipes or sewage backups will usually affect them.

- Expensive items: Collectibles, luxury items, heirlooms, jewelry, expensive wine collections, art, musical instruments, and sporting equipment among many other examples can lead to additional premiums to offset their expenses. Insurers will often offer a separate rider to your policy to insure premium or expensive goods.

Burnaby – Home Insurance quotes, examples

Burnaby home insurance quote #1:

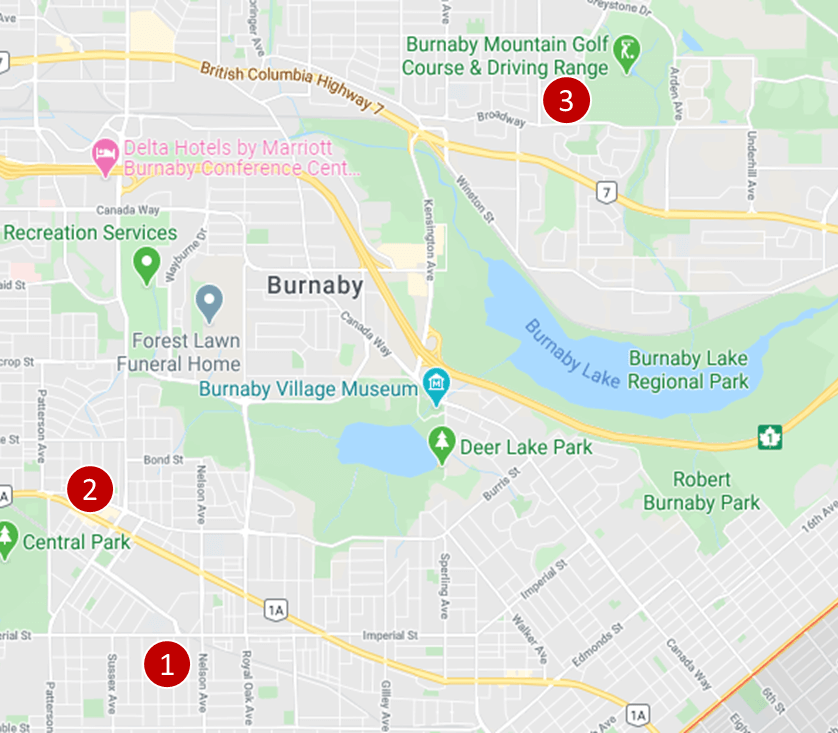

Homeowners insurance for a 2-storey detached brick house under 2,000 sq. feet. This home has an attached garage for 1 car, no basement, and is located next to the intersection of Victory St. and Jubilee Ave.

$67 per month ($804/year)

Burnaby home insurance quote #2:

Homeowners insurance for a 2-bedroom condo under 1,000 sq. feet in a high-rise building. This condo has a monitored burglar alarm. The occupants are non-smokers. Condo building is located near the Patterson Subway Station.

$34 per month ($408/year)

Burnaby home insurance quote #3:

Tenant home insurance for a 2-storey unit in a townhouse, nearly 1,000 sq. feet, no garage, no basement, located nearby Montecito Park.

$24 per month ($288/year)

5 Home Insurance myths to know

Myth #1: You must have home insurance. Home insurance is not government-mandated, in contrast to auto insurance. However, your mortgage lender will often require you to take out an active home insurance policy with them named on it. If you are renting rather than owning, the landlord may require you to have renter’s insurance.

Myth #2: Home insurance covers the market value of my house. Market value is not covered by home insurance. Only the rebuilding or replacement value of the house is covered. Full market value accounts for the price of the land, and in an instance such as when your house burns down, only the structure and materials are replaced, not the land. An insurance policy may include additional costs for debris cleanup.

Myth #3: Home insurance covers earthquakes. A basic, standard home insurance policy will only cover earthquake damage if you purchase an earthquake rider on your policy (which is mostly the case in British Columbia and Quebec). However, some providers will automatically include earthquake coverage (such as Square One Insurance).

Myth #4: If you cannot live in your home, your insurer will pay for you to stay in a similar home. This may not be the case by default. It is important to review your policy to learn the limits of insurance for additional living expenses. Staying in smaller accommodations will help in making your insurance limit go further.

Myth #5: If I am a tenant, my landlord’s insurance covers everything – it is their responsibility. This is not the case. A renter assumes their own liability independent of their landlord’s, so if you flood your neighbours or are prone to break-ins and theft, the costs and consequences are your responsibly. Protect yourself with renter’s insurance.

Frequently Asked Questions (FAQ): Home Insurance in Burnaby

What does Home Insurance cover in Burnaby?

Home insurance coverage depends on the type of insurance you choose:

- Tenant insurance: Covers your personal contents and liability.

- Homeowner insurance (condo): Covers the condo unit and associated upgrades (but not the condo building itself), contents (e.g. theft, damage, etc.), and liability.

- Homeowner insurance (house): Covers the entire rebuilding costs for your home, and, depending on your riders, a range of natural impacts (e.g. earthquake, flooding, snow damages, trees and garden, etc.), liability, additional structures on your land (e.g. shed, storage space, etc.).

Who has the best Home Insurance in Burnaby?

Different home insurance companies specialize on different segments of customers (e.g. seniors, affiliated members of various organizations such as CPA, CAA, etc.), geography, types of buildings, risk types, etc. In order to find the cheapest home insurance, it is important to get a quote from as many insurers as possible and understand what exactly they offer (e.g. level of coverage, deductibles, coverage exclusions, etc.). Our insurance professionals can help you with all these questions.

Home Insurance in Burnaby – Reviews: where to find them?

Our proprietary insurance review platform has been collected independent consumer reviews for different insurance and financial products since 2012 and has thousands of insurance reviews. Click here to access for free all home insurance reviews.

Our Publications related to Home Insurance

Introducing a New Tool to Find Out What Issues Canadian Face with Their Insurers

The arrival of COVID-19 has pushed Canadians, more than ever before, online for finding and applying for insurance and banking products. It is not easy, though, to make the right choice without knowing if a particular insurer will be there when you need them the most. As the largest Canadian review platform with thousands of […]

How Much a Good Condo View is Worth Today?

A prospective buyer is always going to be focused on a condo unit’s view. Unlike a house, these units rarely have multiple windows to the outside in various directions. The exterior wall, which usually is either glass or contains a balcony, is likely the only point of contact with the natural world. While the interior […]

Own your home? You could be eligible for these tax credits and rebates

It’s no secret that property prices in many urban areas of Canada are on fire. And it’s not limited to just the core of Toronto and Vancouver. Houses for sale in Hamilton, for example, have doubled in price in the last decade and houses in Mississauga are almost $750,000. It’s increasingly hard for the average […]

How Competitive is it to Buy a Home in Toronto? INFOGRAPHIC

Toronto real estate has been tumultuous in the last few years. At first, everything was going, up, up and up. Record low-interest rates made huge mortgages more attractive, and few new suburbs were developed thanks to the Greenbelt. Almost 90, 000 Newcomers were moving to Toronto each year, along with Canadians from other parts of […]

Canadian Condo Review Platform CondoEssentials Launched

InsurEye Inc has announced the launch of a new website: CondoEssentials. The new site is a condo review platform that has been designed to better inform Canadians about real estate, with a particular emphasis on condominiums. InsurEye has been informing consumers about details of auto, life and condo insurance for years through thousands of independent […]

| Home Insurance in Alberta | Home Insurance in British Columbia | Home Insurance in Manitoba |

| Home Insurance in Ontario | Home Insurance in Saskatchewan | |