In this home insurance guide for Lethbridge, you’ll learn what to expect for rates, how to find the best coverage, and tips for lowering your homeowners insurance.

What are typical Home Insurance premiums in Lethbridge?

This chart shows average renter’s (which is also called tenant’s) insurance, and homeowner’s insurance in Lethbridge and other locations in Alberta. Renter’s insurance rates are lower than homeowner’s rates because renter’s insurance only covers contents and liability. On the other hand, homeowner’s insurance covers the building, property, contents, liability, and some natural disaster risks.

Home insurance costs in Alberta are relatively high, but not as high as British Columbia. For Albertans, the high costs are driven by natural disaster impacts such as flooding and wildfires.

Flooding has been an increasing issue in Alberta since the major floods in the southern end of the province in 2013. While some insurers added overland flooding protection as a rider to their policies, most still do not include overland flooding as part of the policy. Check with your insurer to see if you have flood coverage, or if you need to purchase a rider for this protection.

Cheap Home Insurance in Lethbridge: 10 Tips

- Renovations: Older homes can cost more to insure if they have not been upgraded or maintained. Renovating to remove old elements like oil heaters and aluminium wiring can save you money on home insurance in Lethbridge.

- Wiring: Avoid aluminum wiring. Not only is it expensive to insure – that is, if you can even get a policy after the mandatory electrical inspection, this type of wiring is a fire hazard.

- Pipes: Galvanized and lead pipes are a health hazard and no longer used in modern construction. Look for, or upgrade to, copper or plastic pipes.

- Wood stoves and fireplaces: Open fire in the home is always a hazard, one insurers defray with higher premiums.

- Water damage: Any signs of water damage are indicative of a larger problem such as leaking pipes, water entry, and mold. Have an inspector check behind the walls for water damage.

- Retirees: Retired? Insurers assume you are home more often, and therefore can spot issues before they get out of hand. Being retired can sometimes get you a discount on home insurance in Lethbridge.

- Stop smoking: Smoking is a huge fire risk. Smokers will always pay more for home insurance.

- Annual vs monthly payments: Annual payments mean much less time administrating the file for your insurer, so they give you a discount for choosing annual over monthly payments.

- Yearly review: Your risks change over time. For example, if you paid off your mortgage, you may need less coverage. Go over your policy every year to ensure your risks are covered, and that you are not over-insured.

- Bundles: Most insurers that offer home and auto insurance provide a discount for those that bundle the policies

5 Elements that will increase your Home Insurance costs

- Fireplaces and wood stoves: They are a nice upgrade, but they are also a fire risk. Expect to pay more if you have a fireplace or a wood stove.

- Oil-based heating: Upgrade to electric heat or a forced-air gas furnace. Not only are they safer options, they help you save money on your home insurance.

- Building frame: Concrete or brick homes suffer less structural fire damage. This is why wood frame homes are more expensive to insure.

- Expensive items: Furs, fine wine, art, sporting gear, musical instruments – these can be over the limit of your contents policy. You may need a separate rider for expensive items.

- Finished basement: Finished basements add value to the home but also cost more to fix if they flood. You could pay a higher premium for a home with a finished basement.

Lethbridge Home Insurance quotes, examples

Lethbridge home insurance quote #1:

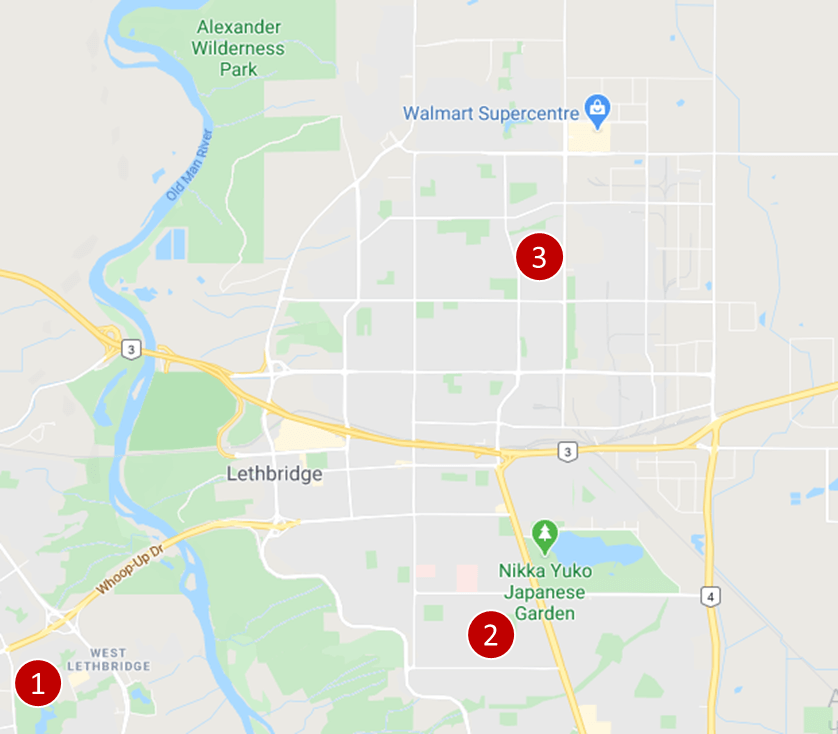

Homeowners insurance for a 1-storey detached house located in west Lethbridge next to Lafayette Park. This is a home under 1,500 sq ft, no basement, wood frame, new roof, bundled with auto insurance.

Price: $120 per month ($1,440/year)

Lethbridge home insurance quote #2:

Homeowners insurance for a 2-storey detached house. This is a brick home with an attached single-car garage, fully-finished basement, located next to Gilbert Paterson Middle School.

$124 per month ($1,489/year)

Lethbridge home insurance quote #3:

Tenants’ insurance for a 1-storey brick detached house, under 1,000 sq ft, new roof, no basement, located next to Labor Club Park:

Price: $24 per month ($288/year)

5 Home Insurance myths to know

Myth #1: You must have home insurance – it’s the law

If you have paid off your mortgage and are not renting, home insurance is recommended but not mandatory. However, a lender has every right to ask you to insure the home and name them on the policy, and a landlord can require tenant’s insurance as part of the rental agreement.

Myth #2: All my contents are covered

Contents insurance has a maximum. Items like fine art, wine collections, and heirloom jewelry may be above that maximum. Ask your insurer if you need an appraisal and separate rider for expensive items in your home.

Myth #3: Insurance is cheaper for older, less expensive homes

Older homes are more expensive to insure if they have not been maintained and upgraded. This is because there is a greater risk of shingles failing, oil heaters causing a fire, pipes breaking, etc.

Myth #4: If my car is stored in my garage, it is covered by my home insurance policy

Your car needs comprehensive auto coverage for damage it sustains while in your garage. It is not covered by your home insurance policy.

Myth #5: I don’t need insurance if I’m renting

Your landlord’s insurance does not cover your contents or your liability. If someone is hurt on the property due to your negligence (such as a dog bite or a fall in your unit), or someone steals from your unit or storage locker, you are responsible. Tenant’s insurance is needed to cover these risks.

Frequently Asked Questions (FAQ): Home Insurance in Lethbridge

hat does Home Insurance cover in Lethbridge?

Coverage for homeowners insurance in Lethbridge depends on the type of insurance you need.

- Tenants insurance: Tenants, also known as renter’s, insurance covers your unit’s contents, storage locker, and liability.

- Homeowners insurance (house): Robust coverage that includes the rebuilding value of your home along with liability and some protection for natural disasters (other disasters like floods, earthquakes, and landslides can be added via riders if not included).

How much is Home Insurance in Lethbridge?

The cost of homeowners insurance in Lethbridge depends on the risk profile of your home and property, and the type of dwelling in which you live.

- Tenant insurance is the cheapest. It can be as little as $20/month.

- Homeowners insurance for a house varies because it depends on many factors like the size of the home, the location, the risks in the area (flooding, earthquakes, etc.) the condition/maintenance of the home, the type of wiring, the presence of a fire place and more.

Who has the cheapest Home Insurance in Lethbridge?

Since different insurers specialize in different demographics, the best way to get the cheapest home insurance in Lethbridge is to compare a variety of quotes from several companies. Some companies offer better rates for tenant insurance, others, for homeowners. Some are a better fir for rural communities, others tend to focus on cities and larger towns (e.g. if they have more knowledge in underwriting insurance in particular geographical areas). Some cover seniors or affiliated groups. Our insurance professionals have access to more than 30 Canadian insurance companies and will, for free, compare the market on your behalf and present you with the best quotes for the coverage you need.

Who has the cheapest Home Insurance in Lethbridge?

Our proprietary insurance review platform has been collecting independent consumer reviews since 2012 for all types of insurance and financial products. Click here for free access to thousands of reviews.

Our Publications related to Home Insurance

Introducing a New Tool to Find Out What Issues Canadian Face with Their Insurers

The arrival of COVID-19 has pushed Canadians, more than ever before, online for finding and applying for insurance and banking products. It is not easy, though, to make the right choice without knowing if a particular insurer will be there when you need them the most. As the largest Canadian review platform with thousands of […]

How Much a Good Condo View is Worth Today?

A prospective buyer is always going to be focused on a condo unit’s view. Unlike a house, these units rarely have multiple windows to the outside in various directions. The exterior wall, which usually is either glass or contains a balcony, is likely the only point of contact with the natural world. While the interior […]

Own your home? You could be eligible for these tax credits and rebates

It’s no secret that property prices in many urban areas of Canada are on fire. And it’s not limited to just the core of Toronto and Vancouver. Houses for sale in Hamilton, for example, have doubled in price in the last decade and houses in Mississauga are almost $750,000. It’s increasingly hard for the average […]

How Competitive is it to Buy a Home in Toronto? INFOGRAPHIC

Toronto real estate has been tumultuous in the last few years. At first, everything was going, up, up and up. Record low-interest rates made huge mortgages more attractive, and few new suburbs were developed thanks to the Greenbelt. Almost 90, 000 Newcomers were moving to Toronto each year, along with Canadians from other parts of […]

Canadian Condo Review Platform CondoEssentials Launched

InsurEye Inc has announced the launch of a new website: CondoEssentials. The new site is a condo review platform that has been designed to better inform Canadians about real estate, with a particular emphasis on condominiums. InsurEye has been informing consumers about details of auto, life and condo insurance for years through thousands of independent […]

| Home Insurance in Alberta | Home Insurance in British Columbia | Home Insurance in Manitoba |

| Home Insurance in Ontario | Home Insurance in Saskatchewan | |