For those wanting to live north of Toronto yet remain close to the city, Richmond Hill is the answer. Our home insurance guide for Richmond Hill provides information about policy prices along with tips on how to reduce your insurance costs while selecting the best policy for your needs.

What are typical Home Insurance cost in Richmond Hill?

As shown by this chart, there is difference between the premiums renters and homeowners pay. This is because renter’s insurance, which is also known as tenant insurance, only covers contents and sometimes, liability. On the other hand, homeowner insurance covers the building, property, some natural disaster risks, and liability.

Typically, those in Ontario spend less on home insurance than consumers in Alberta and British Columbia. The reason is fewer natural disaster risks, such as the earthquakes experienced in British Columbia, or the flooding seen in parts of Alberta. However, the last few years have shown that nature doesn’t always spare Ontario as floods and ice storms are increasingly impacting the region – and when natural disasters impact the area, they also impact home insurance rates.

Most home insurers in Canada now cover overland flooding (where water enters the home from the outside due to swollen rivers, fast snow melt, excessive rain, etc.). Sometimes it is sold as optional coverage called an overland flooding endorsement/rider, or it comes bundled with other coverage such as sewer backup. It may not automatically be part of your main policy. To ensure you are covered, check your policy and speak with your advisor.

Cheap Home Insurance in Richmond Hill: 10 Tips

- New home: BCAA and Wawanesa are two insurers that provide a new home discount. Check to see if your insurer does as well.

- Decrease liability risk: Take the necessary self-directed steps to decrease your liability. Put your aggressive dog on a leash. Fence off your pool. Keep snow and ice off your stairs and sidewalk.

- Plumbing insulation: Reduce or even avoid pipe-bust claims by insulating your pipes.

- Professional memberships: Some insurers offer group or discount insurance rates to members of professional organizations, such as the Certified Management Accountants of Canada. Meloche Monnex Insurance is one such group that does this.

- Alumni: University of Toronto, McGill University, and NAIT are just a few of the alumni associations that can qualify for a discount through select providers such as TD Insurance.

- Heating: Oil heating is seen as outdated and a high fire and environmental risk. Insurers prefer to see forced-air gas or electric heating in your home.

- Approved wiring: Aluminum wiring is very difficult to insure. Any insurer that does cover it will likely request a full electrical house inspection. Upgrade to, or buy a house with, modern, approved wiring.

- Stop smoking: Smoking can add to your premium because it is such a high fire risk. It’s also bad for your health.

- Mortgage insurance vs. life insurance: Mortgage insurance is a form of life or critical illness insurance. It pays off the outstanding balance of your mortgage in the case of a tragic event. However, a large enough life insurance policy can do the same while having some left over for your beneficiaries. Term life insurance is usually a cheaper and more flexible option.

- Rebuilding vs. market costs: Instead of covering the market cost of your home, consider the rebuilding costs instead. Covering the rebuilding costs is generally more affordable.

5 Elements that will increase your House Insurance costs

- Swimming pools: Pools present a great deal of risk, especially when not fenced. This liability can be costly.

- Old house elements: Unless renovated, older homes have elements that can be more expensive to insure, such as old roofs, wiring, and plumbing. This is because they are not as safe, productive, or environmentally friendly as their upgraded counterparts.

- Basement: During a flood or sewer backup, water flows down, which is bad news for finished basements. This is why finished basements can increase your insurance costs.

- Roof type: Insurers favour more reliable roofing systems. Wood shake and shingle are among the least reliable options.

- Business property: Is your home also your place of business? You increase your liability and risk of asset loss if you have people coming onto the property to conduct business, and/or if you store business equipment in your home.

Richmond Hill Home Insurance quotes, examples

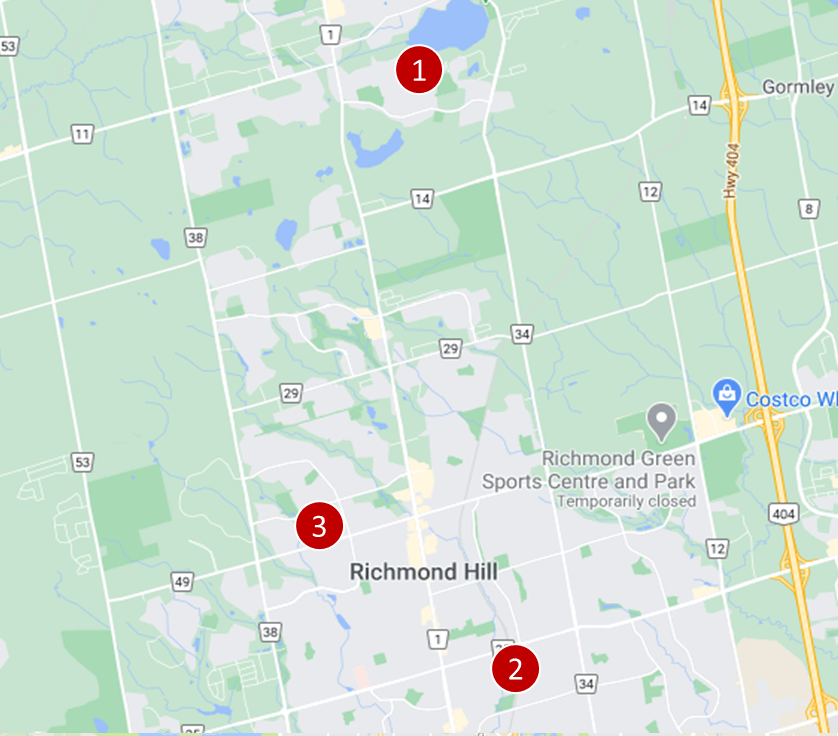

Richmond Hill home insurance quote #1:

Homeowners insurance for a 2.5-storey detached brick house, about 1,750 sq. ft., a built-in garage for 2 cars, no basement, equipped with a monitored burglar alarm, bundled with auto insurance and located in the Oak Ridges area nearby Moraine Park:

Price: $68 per month ($816/year)

Richmond Hill home insurance quote #2:

Homeowners insurance for a 2-bedroom condo unit in a low-rise brick building with non-smoker occupants. The building is located on Major Mackenzie Dr E next to the Richmond Hill Go Train Station:

Price: $30 per month ($360/year)

Richmond Hill home insurance quote #3:

Tenant insurance for a 2-storey detached brick house, about 1,500 sq. ft. This home has a built-in garage for 2 cars and no basement. Located next to Silver Pines Public School:

Price: $38 per month ($456/year)

5 Home Insurance myths to know

Myth #1: You must have home insurance according to the law

You may think this because auto insurance is mandatory, but home insurance is not. However, if your lender requests that you have active home insurance and name them on the policy, or if your landlord mandates renters insurance, in those cases you must comply.

Myth #2: Only my home is covered

Home insurance covers the house and your contents, along with structures on the property like your shed. Typically, there is also an additional living expense that is covered, along with some natural element risks. Condo insurance also covers unit improvements and some assessment risks. Policies vary, so always read your coverage carefully and speak with a broker or advisor if needed. Our overview of condo insurance (including quoting) will explain the details of condo insurance coverage.

Myth #3: I can overestimate the damage

Never do this. Your insurer investigates each claim and if its apparent that you have overstated the damage and loss, your claim can be denied, and your policy cancelled. This damages your credibility, making it much harder to find a new policy elsewhere.

Myth #4: If I make a home insurance claim, my insurance costs will go up

In some cases, the insurer will simply remove your zero claims discount, or give you first claim forgiveness.

Myth #5: My child is in college or university and their belongings are fully covered

If your policy provides coverage for a student’s belongings while they live on campus, there is usually a coverage cap. Square One is one of the few that has no sub-limit for students’ property. If your child is renting a unit off campus, they will need their own tenants insurance.

Frequently Asked Questions (FAQ): Home Insurance in Richmond Hill

What does Home Insurance cover in Richmond Hill?

What does coverage for homeowners in Richmond Hill consist of? It depends on the type of insurance you need. Here’s a quick overview.

- Tenants insurance: Also known as renter insurance, tenants insurance covers your contents, your liability, and the items in your storage locker.

- Homeowners insurance (condo): Your condo unit and the upgrades you make to it are covered, along with your contents (for theft and damage, etc.) and your liability. The building itself (roof, common areas, etc.) are covered by the condo corporation’s policy.

- Homeowners insurance (house): The most robust type of coverage, you are protected for the rebuilding value of the home, some natural disasters (with coverage for disasters like overland flooding and landslides available through riders – if not covered by the main policy), liability, and some outdoor elements like your garden shed.

How much is Home Insurance in Richmond Hill?

The cost of homeowners insurance in Richmond Hill depends on a variety of factors, including but not limited to the risk profile of your home, the geographical location, and the type of dwelling.

- Tenant insurance is the cheapest and it can be as little as $20/month.

- Homeowners insurance for a condo is very affordable since it only covers your condo unit and your upgrades, contents, and liability. You will typically pay around $20-$50/month.

- Homeowners insurance for a house varies because of the variety of factors, like the size of the house, the geographical location, the specific risks (such as flooding or earthquakes), the age and condition of the home, whether or not wiring has been upgraded, the presence of a pool or fire place, etc. Homeowners insurance rates can start at $50/month and go as high as several hundred dollars per month depending on your property.

Remember, however, that not everything is automatically covered. You may need additional coverage, known as riders, for business assets on your property if you work from home, or expensive items like wine collections, fine art, and jewellery. Be sure to know and understand the details of your coverage because aspects like the deductible and coverage caps will impact the final price.

Who has the best Home Insurance in Richmond Hill?

Insurers tend to specialize in different demographics, so the best way to get the cheapest home insurance in Richmond Hill is to get a variety of quotes from several companies and compare them. This way you get the best quote for your rural property, your condo, your town home, or as a member of an alumni or affiliate group.

Our insurance professionals are happy to help you get and understand a wide variety of quotes. We have access to more than 30 Canadian insurance company and will compare your options, for free, on your behalf to ensure you get the best quotes for the coverage you need.

Home Insurance in Richmond Hill – Reviews: where to find them?

Our proprietary insurance review platform has been collecting independent consumer reviews since 2012, and we have reviews for a very large variety of insurance and financial products. Click here for free access to thousands of consumer reviews.

Our Publications related to Home Insurance

Introducing a New Tool to Find Out What Issues Canadian Face with Their Insurers

The arrival of COVID-19 has pushed Canadians, more than ever before, online for finding and applying for insurance and banking products. It is not easy, though, to make the right choice without knowing if a particular insurer will be there when you need them the most. As the largest Canadian review platform with thousands of […]

How Much a Good Condo View is Worth Today?

A prospective buyer is always going to be focused on a condo unit’s view. Unlike a house, these units rarely have multiple windows to the outside in various directions. The exterior wall, which usually is either glass or contains a balcony, is likely the only point of contact with the natural world. While the interior […]

Own your home? You could be eligible for these tax credits and rebates

It’s no secret that property prices in many urban areas of Canada are on fire. And it’s not limited to just the core of Toronto and Vancouver. Houses for sale in Hamilton, for example, have doubled in price in the last decade and houses in Mississauga are almost $750,000. It’s increasingly hard for the average […]

How Competitive is it to Buy a Home in Toronto? INFOGRAPHIC

Toronto real estate has been tumultuous in the last few years. At first, everything was going, up, up and up. Record low-interest rates made huge mortgages more attractive, and few new suburbs were developed thanks to the Greenbelt. Almost 90, 000 Newcomers were moving to Toronto each year, along with Canadians from other parts of […]

Canadian Condo Review Platform CondoEssentials Launched

InsurEye Inc has announced the launch of a new website: CondoEssentials. The new site is a condo review platform that has been designed to better inform Canadians about real estate, with a particular emphasis on condominiums. InsurEye has been informing consumers about details of auto, life and condo insurance for years through thousands of independent […]

| Home Insurance in Alberta | Home Insurance in British Columbia | Home Insurance in Manitoba |

| Home Insurance in Ontario | Home Insurance in Saskatchewan | |