Residents of Oakville love its easy connection to Toronto via the Go Train, the beautiful waterfront, the charm of Bronte Park, the winding Lakeshore Road, the serene marina, and the area’s many other attributes. If you live in, or are considering moving to Oakville, this home insurance guide for Oakville will help you understand and choose the best policy to protect your property. You will also learn tips on how to reduce your home insurance costs in Oakville.

What are typical Home Insurance cost in Oakville?

This chart shows average renters and homeowners insurance premiums in Ontario, home insurance in Oakville, and policy prices in other provinces across Canada. In most cases, renter’s insurance is lower than homeowners because of the differences in what is covered. Renters insurance typically covers your contents, and sometimes your liability. On the other hand, homeowners insurance covers your dwelling, property, contents, liability, and some natural impacts like storm damage.

An issue increasingly affecting Ontario is flooding. Most insurers in Canada cover overland flooding, which is defined by water entering your home due to outside sources like an overflowing river or rapidly melting snow. We strongly suggest that you check with your insurer to see if you are covered, or if you must purchase optional coverage which is sometimes called an overland flooding endorsement. Sometimes it is available bundled with other coverage such as sewer backup protection.

How to save on Home Insurance in Oakville: 10 Tips

- New Home: Buying a new home can get you a discount with some insurers. BCAA and Wawanesa are two that offer this perk.

- Monitoring: Do you have security cameras? A doorman? A guard on the premises? If so, this may qualify you for a discount.

- Annual vs. monthly payments: By paying annually instead of monthly, you save the insurer time and administration costs. Some insurers pass these savings back to you in the form of a lower premium.

- Annual review: Your insurable risks change annually. Check your policy once a year to ensure you remain adequately covered and are not paying for coverage that you no longer need.

- Mortgage insurance: Did you know that you may not need both mortgage and life insurance? Mortgage insurance, issued through a lender/bank, is a form of critical illness, life, and disability insurance, but it only pays the bank to clear your outstanding mortgage debt. However, an individual life insurance policy may have enough to cover the mortgage debt and have some remaining for your beneficiaries – and term life insurance is usually the cheaper option of the two.

- Credit score: A perk of having a good credit score is that it can get you a lower premium. Many insurers look at your credit score when calculating your home insurance premium.

- Bundle: If the company offers other coverages such as auto insurance, you can receive a discount for bundling insurance.

- Rebuilding vs. market costs: There is a difference between rebuilding costs and market price when it comes to selecting coverage. Market price can be quite a bit higher than rebuilding costs. Take this into consideration when choosing aspects of your coverage.

- Pool: Owning a private pool increases your liability, especially if the pool is unfenced. Higher liability means higher insurance rates.

- Heating: Insurers have a preference when it comes to your furnace. They like forced-air gas or electric heat. Oil heated homes, on the other hand, can drive up your insurance rates. Oil heaters are outdated and not very environmentally friendly. They are also a fire risk. These factors increase your cost of insurance.

5 Elements that will increase your Home Insurance costs

- Fireplaces and woodstoves: Woodstoves and fireplaces are potential sources of fire and smoke damage. They may increase your insurance costs, and may also require you to get a home inspection prior to obtaining an insurance policy.

- Knob and tube wiring: Either avoid knob and tube wiring or replace it as soon as possible! This outdated type of wiring uses connectors with knobs to isolate wires. It is not preferred by insurers because it is insufficient for today’s high energy consumption levels. With this type of wiring you will be subjected to higher premiums or even requested to get the house rewired before a policy is offered.

- Galvanized or lead pipes: Galvanized or lead pipes are not considered reliable by insurers. Additionally, they can build up corrosion, which impacts water pressure. Lead has been known to cause health issues if it gets into drinking water. Modern copper or plastic pipes are better for your health and your home insurance premium.

- Roofing: Not all roofs are considered equal by insurance companies, and these differences are reflected in your insurance premiums. The least reliable roofs are wood shake or shingle.

- Garden and Trees: Beautiful trees, a garden, and a fence are not risk elements, but do have to be covered in case of damage. This is why, in most cases, you will pay extra coverage.

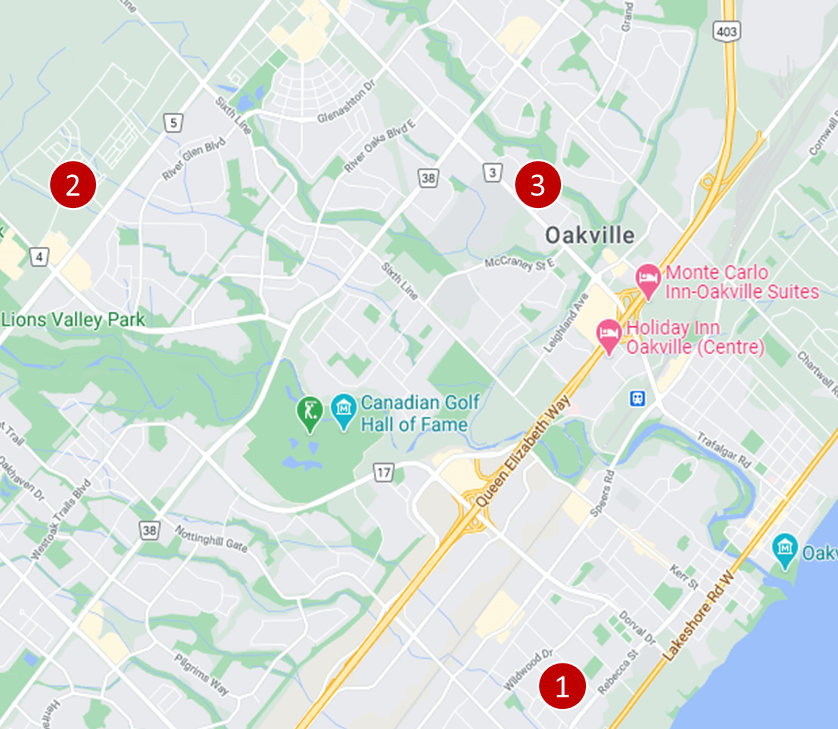

Oakville – Home Insurance quotes, examples

Oakville home insurance quote #1:

Homeowners insurance for a two-storey detached brick house that is about 1,700 sq. feet. No basement, bundled with auto insurance, has an attached garage for two cars and pool in the courtyard. Located in West Oakville.

Price: $108 per month ($1,296/year)

Oakville home insurance quote #2:

Tenant home insurance for a two-storey townhouse unit. It has a single built-in garage, monitored burglar alarm and no basement. Located next to Oodenawi Public School.

Price: $26 per month ($312/year)

Oakville home insurance quote #3:

Homeowners insurance for a two-bedroom condo under 1,000 sq. feet in a high-rise condo building. Located in Holton Heights on White Oaks Blvd.

Price: $28 per month ($336/year)

5 Home Insurance myths to know

Myth #1: When I am away on vacation, my house is covered

Unless you take some necessary precautions, which will be explained in your policy, you are not covered when away from the residence for a length of time like a vacation. If it is winter, you may need to empty the pipes and shut off the water supply. You may also be required to ensure the heating is maintained. If you fail to do this and experience a pipe burst, you may not have a successful claim. Also check with your insurer to determine how often someone must visit your premises while you are away. While policies differ, it is typical every 3-7 days.

Myth #2: Termite and insect damage are covered

This is not typically covered. Be sure to read and understand the policy so you know if this is covered or not if you live in an area where insect damage is a concern.

Myth #3: I’m paying for home insurance, so I should make every possible claim under it

This is not a good idea. Each claim has a deductible. If the claim is less than the deductible it will not pay out. You could also lose your claim free discount, so take that overall cost into consideration too. It may be three years before you qualify for a claim free discount again. Multiple claims could subject you to surcharges, or a refusal by the insurer to offer a renewal.

Myth #4: If you cannot live in your home, your insurer will pay for you to stay in a similar home

When your home is damaged to the point of being unliveable, your policy will have limits on your additional living expenses. You may also have a time cap on your alternative living arrangements, for example, not being able to stay in a hotel longer than six or 12 months. You may wish to secure modest accommodations to make your living allowance go further.

Myth #5: Home insurance pays for renos, upgrades, and routine maintenance

The usual wear and tear, and non-essential renovations, on your home are not covered. Insurance is for events such as damage from fire, hail, or a storm.

Frequently Asked Questions (FAQ): Home Insurance in Oakville

What does Home Insurance cover in Oakville?

Home insurance coverage in Oakville depends on the type of insurance you choose. Here’s an overview:

- Tenant insurance: covers only contents and your liability.

- Homeowner insurance (condo): covers your unit, and unit upgrades. It also covers contents against theft, damage, and liability. The building itself (known as the building envelope) and the common areas are not covered. The condo corporation’s insurance policy covers the building envelope and the common areas.

- Homeowner insurance (house): the most robust coverage, this protects your home, contents, structures on your land (like your storage shed) and liability. Depending on your riders, a range of natural impacts are also covered, such as earthquakes, flooding, and damage to your garden and trees.

Who has the best Home Insurance in Oakville?

Home insurance companies specialize in different population segments. For example, some specialize in working with seniors, others with alumni, and some with organizations like CPA and CAA. Some insurers specialize in the specific risks due to the property’s geographical location or type of dwelling. To find the cheapest home insurance, get a variety of quotes to compare the rates and what coverages are offered. Understand the differences in the levels of coverage, deductible, exclusions, etc. Our insurance professionals are happy to help you with your questions.

Home Insurance in Oakville – Reviews: where to find them?

Our proprietary insurance review platform has been collecting independent consumer reviews for a variety of different insurance and financial products since 2012. Click here to access, for free, thousands of home insurance reviews.

Our Publications related to Home Insurance

Introducing a New Tool to Find Out What Issues Canadian Face with Their Insurers

The arrival of COVID-19 has pushed Canadians, more than ever before, online for finding and applying for insurance and banking products. It is not easy, though, to make the right choice without knowing if a particular insurer will be there when you need them the most. As the largest Canadian review platform with thousands of […]

How Much a Good Condo View is Worth Today?

A prospective buyer is always going to be focused on a condo unit’s view. Unlike a house, these units rarely have multiple windows to the outside in various directions. The exterior wall, which usually is either glass or contains a balcony, is likely the only point of contact with the natural world. While the interior […]

Own your home? You could be eligible for these tax credits and rebates

It’s no secret that property prices in many urban areas of Canada are on fire. And it’s not limited to just the core of Toronto and Vancouver. Houses for sale in Hamilton, for example, have doubled in price in the last decade and houses in Mississauga are almost $750,000. It’s increasingly hard for the average […]

How Competitive is it to Buy a Home in Toronto? INFOGRAPHIC

Toronto real estate has been tumultuous in the last few years. At first, everything was going, up, up and up. Record low-interest rates made huge mortgages more attractive, and few new suburbs were developed thanks to the Greenbelt. Almost 90, 000 Newcomers were moving to Toronto each year, along with Canadians from other parts of […]

Canadian Condo Review Platform CondoEssentials Launched

InsurEye Inc has announced the launch of a new website: CondoEssentials. The new site is a condo review platform that has been designed to better inform Canadians about real estate, with a particular emphasis on condominiums. InsurEye has been informing consumers about details of auto, life and condo insurance for years through thousands of independent […]

| Home Insurance in Alberta | Home Insurance in British Columbia | Home Insurance in Manitoba |

| Home Insurance in Ontario | Home Insurance in Saskatchewan | |