Welcome to the complete home insurance guide for Prince George. Here you will find average home insurance premiums in British Columbia, learn about how to save on insurance, explore tips on getting the best policy and even learn about some common myths. Enjoy our comprehensive guide so you can choose the best homeowners insurance in Prince George.

What are average Home Insurance cost in Prince George?

Our chart demonstrates average renters and homeowners insurance premiums in British Columbia, in Prince George, and in other locations across Canada. Renters insurance rates are usually lower than homeowners rates. This is because of the very nature of the policy. Renters coverage is for the contents and (sometimes) liability only. Homeowners insurance, on the other hand, covers the dwelling, property, liability, and several other perils.

When comparing other provinces across Canada, homeowners in British Columbia tend to spend more on insurance. Here is why:

- Earthquakes: Additional coverage is required to protect against the seismic activity in the province, especially along the coast.

- High rebuilding costs: There is a high share of expensive real estate, which impacts insurance premiums. Even though home insurance is driven by rebuilding, not market value, more expensive properties are more expensive to rebuild. Additionally, some construction accounts for seismic hazards, which further drive up the costs (for example lateral bracing).

How to save on Home Insurance in Prince George: 10 Tips

- Anti-theft systems: Some insurers, like The Personal, provide a discount if you have a home alarm system.

- Decrease liability risk: Use a common sense approach for known risks. For example, fence off your pool, contain your aggressive dog, and shovel the snow and ice from your walkway.

- Plumbing insulation: Avoid or reduce insurance claims by insulating your pipes. This helps prevent them from freezing in the winter.

- Hydrants and fire-station: Some insurers will provide a discount if you live close to a hydrant or fire station.

- Employee/Union members: Some organizations, like IBM Canada and Research in Motion offer discounts to union members. Ask if yours also provides a discount.

- Dependent students: Students that live in their own apartment but are still classified as dependents may be covered by their parent’s insurance policy. Desjardins is one insurer that offers this benefit at no extra charge.

- Annual vs. monthly payments: Everyone likes to save time and money and insurers are no exception! When you pay annually instead of monthly, they save on time, postage, filing, and administration. This is why those that pay annually have a lower premium.

- Mortgage-free home: Paid off your home? Some insurers, like RBC Insurance and the Cooperators, will lower your premium when you pay off your mortgage.

- Leverage inflation: Did you know that many insurers will actually increase your dwelling limit annually by taking into consideration the inflation of your home’s rebuilding cost? Ensure that this adjustment is not out of line with actual inflation costs, or you will wind up overpaying on your policy.

- Repair instead claims: For smaller claims, if the damage is less than the cost of your deductible, or can be affordably fixed without a claim, consider doing the repairs at your own costs.

5 Elements that will increase your Home Insurance costs

- Expensive items: Items like fine wines, jewelry, art collections, sports gear, expensive watches, and furs can be above the limits of your contents insurance and require a rider in order to be covered.

- Business property: Is your home also your place of business? When you have clients coming and going, such as in a home-based consultancy, bed and breakfast, or daycare, you have higher liability risks and higher risks to your assets.

- Knob and tube wiring: This outdated, unsafe, high energy consumption wiring is not looked upon favourably by home insurers. Most insist on a full inspection by a certified electrician and some may even ask you to have the home re-wired. If you find an insurer that will provide a policy for a home with knob and tube wiring, expect to pay an additional premium.

- Roof type: Not all roof types are seen as equal in the eyes of insurers. They consider wood shake and shingle as the least reliable.

- Garden and Trees: Gardens and beautiful trees are not necessarily considered high risk, but in some cases, you will pay extra to have some types of landscaping covered.

Prince George – Home Insurance quotes, examples

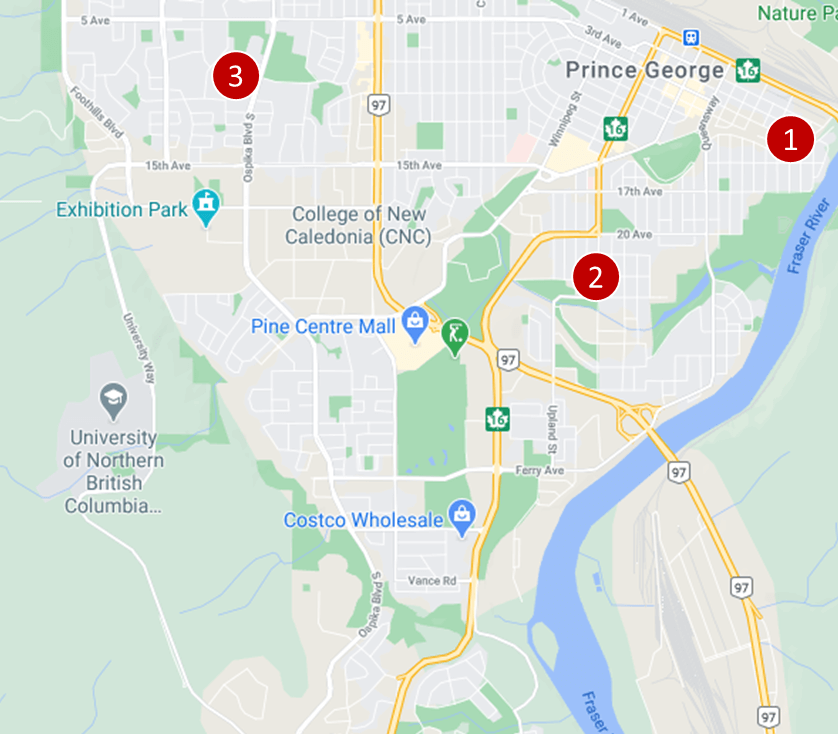

Prince George home insurance quote #1:

Homeowners home insurance for a one-storey detached house under 1,000 sq. feet. Structure details: wooden frame and wooden exterior siding. This house has no garage or basement. Located on Patricia Blvd.

Price: $77 per month ($924/year)

Prince George homme insurance quote #2:

Tenant home insurance for a two-storey townhouse unit, under 1,000 sq. feet. The occupants are non-smokers. This home has no garage or basement. Located on Victoria St nearby Milburn Park.

Price: $28 per month ($336/year)

Prince George home insurance quote #3:

Homeowners insurance for a two-storey detached brick house, ~1,500 sq. feet. This house has a new roof, a built-in garage for one car and mostly finished basement. Located on Ospika Blvd S nearby Rainbow Park.

Price: $98 per month ($1,176/year)

7 Home Insurance myths to know

Myth #1: If I am away on vacation, I’m still automatically covered

Check your policy carefully as it will detail how to ensure continued coverage while on vacation or away for an extended period of time. If you are away during the winter you may need to shut off the water supply, empty the pipes, and ensure the heating cycle is maintained to prevent frozen and burst pipes. You will also likely need to have someone visit the home every three to seven days.

Myth #2: Home insurance automatically covers upgrades to the home or condo

Do not assume that upgrades are automatically covered when you renovate your kitchen, washroom, etc. You do need to inform your insurance provider of the upgrades, and you also need to understand how each insurer treats upgrades for your home or condo.

Myth #3: Insurance is cheaper for older, less expensive homes

The opposite is often true! With older homes comes older plumbing and roofing, etc. Unless there are renovations and upgrades, older – and therefore riskier – elements are more costly to insure.

Myth #4: If you cannot live in your home, your insurer will pay for you to stay in a similar size and style of home

Your insurer has limits on your additional living expenses. Consider staying in smaller accommodations to stretch the value of this coverage and be sure to know how many months you can live in the alterative arrangement. Some insurers cap a hotel stay at six or 12 months.

Myth #5: Insurance covers damages caused by termites and other insects

Termite and insect damage are not typically covered, so be sure to read your policy carefully to understand how your insurer treats these kind of claims.

Myth #6: If a car is stored in a garage, it is covered by the home insurance policy

Your car in your garage is actually covered by your auto’s comprehensive coverage policy, not your home insurance policy.

Myth #7: My belongings, left in a storage locker that I rent, are protected by my home insurance

Short or long-term storage rental facilities are typically excluded from the coverage unless that locker is the basement of the apartment/condo building where you live, and is considered part of your rental/condo unit agreement.

Frequently Asked Questions (FAQ): Home Insurance in Prince George

What does Home Insurance cover in Prince George?

Home insurance coverage in Prince George depends on the type of insurance you choose:

- Tenant insurance: protects your contents and liability.

- Homeowner insurance (condo): protects the condo unit and upgrades but not the building envelope as that is the responsibility of the condo corporation. Your policy, however, does include coverage for contents (e.g. theft, damage, etc.) and liability.

- Homeowner insurance (house): robust coverage for the rebuilding costs for your home, and, depending on your riders, a range of natural impacts like earthquake, flooding, and snow damage. Also covered is your liability, and additional structures on your land (e.g. shed, storage space, etc.).

Who has the best Home Insurance in Prince George, BC ?

Some home insurers specialize in different population segments. For example, one may focus on insuring senior’s dwellings while another provides coverage for members of affiliated organizations like CPA and CAA. Others focus on geography, building types, or specific risk factors. To find the cheapest home insurance in Prince George, get a quote from as many insurers as possible and understand what they offer in terms of coverage, deductible, exclusions, etc. Our insurance professionals are happy to help with this.

Home Insurance in Prince George – Reviews: where to find them?

Since 2012, our proprietary insurance review platform has collected independent consumer reviews for a variety of insurance and financial products. Click here for free access all our home insurance reviews.

Our Publications related to Home Insurance

Introducing a New Tool to Find Out What Issues Canadian Face with Their Insurers

The arrival of COVID-19 has pushed Canadians, more than ever before, online for finding and applying for insurance and banking products. It is not easy, though, to make the right choice without knowing if a particular insurer will be there when you need them the most. As the largest Canadian review platform with thousands of […]

How Much a Good Condo View is Worth Today?

A prospective buyer is always going to be focused on a condo unit’s view. Unlike a house, these units rarely have multiple windows to the outside in various directions. The exterior wall, which usually is either glass or contains a balcony, is likely the only point of contact with the natural world. While the interior […]

Own your home? You could be eligible for these tax credits and rebates

It’s no secret that property prices in many urban areas of Canada are on fire. And it’s not limited to just the core of Toronto and Vancouver. Houses for sale in Hamilton, for example, have doubled in price in the last decade and houses in Mississauga are almost $750,000. It’s increasingly hard for the average […]

How Competitive is it to Buy a Home in Toronto? INFOGRAPHIC

Toronto real estate has been tumultuous in the last few years. At first, everything was going, up, up and up. Record low-interest rates made huge mortgages more attractive, and few new suburbs were developed thanks to the Greenbelt. Almost 90, 000 Newcomers were moving to Toronto each year, along with Canadians from other parts of […]

Canadian Condo Review Platform CondoEssentials Launched

InsurEye Inc has announced the launch of a new website: CondoEssentials. The new site is a condo review platform that has been designed to better inform Canadians about real estate, with a particular emphasis on condominiums. InsurEye has been informing consumers about details of auto, life and condo insurance for years through thousands of independent […]

| Home Insurance in Alberta | Home Insurance in British Columbia | Home Insurance in Manitoba |

| Home Insurance in Ontario | Home Insurance in Saskatchewan | |