Welcome to your best home insurance guide for Mississauga. In the last few years, Mississauga grew significantly and became one of the preferred living locations for Ontarians who work in Toronto. A number of companies also call Mississauga home. Many new complexes, condos, and private homes have been built here recently. This page discusses home insurance premiums in Ontario and also discusses how to save money on your insurance policy. Read on for home insurance tips in Mississauga.

What are typical Home Insurance premiums in Mississauga?

The chart shows average Renters and Homeowners insurance in Mississauga, Ontario, and other locations. Did you notice that renters insurance is lower than homeowners? This is because renters only covers contents and, sometimes, liability. Homeowners insurance, on the other hand, covers the dwelling as well as some contents and the physical property.

Ontario may have some of the highest car insurance rates in Canada, but residents of this province spend less on home insurance than those in Alberta or British Columbia. This is due to less risk from things like earthquakes and flooding.

However, that is not to say that Ontario is immune to such risks as recent flooding and ice storms have shown. In fact, one of the growing topics of concern in the past few years are the floods that are starting to impact Ontario.

Most insurers in Canada now cover overland flooding – that is, flooding that enters your home from outside sources. Sometimes this coverage is available as a rider. It is always advisable to have coverage for overland flooding and sewer backup. Ensure you check with your provider to see if you are covered or if you need a rider.

How to save on Home Insurance – 10 Tips

- Bundle: Does your insurance company also offer auto or life insurance? Bundle the policies to get a discount.

- Credit score: Yet another reason to maintain a good credit score – insurers will factor in your financial risk factor when they calculate your premiums. The more of a risk you are, the more you can wind up paying.

- Neighbourhood: Low crime neighbourhoods are ideal for your personal safety, and also come with lower premiums on home insurance.

- Water damages: Make sure your home inspector does a very complete check for water damage. Any damage in the home could mean expensive repairs or ongoing issues.

- Pipes: Galvanized and lead pipes are more than outdated – they are dangerous. Insurers don’t like to cover these and if they do, you’ll pay plenty extra.

- Change your content coverage: Check your contents coverage limits. It could be too high! If your contents don’t match the value in your policy, ask for it to be lowered, which can also lower your premium.

- Direct insurers: Brokers provide great value by offering a range of choices but sometimes direct insurers, also known as captive agents, can get you a lower price on the product they sell.

- Annual vs. monthly payments: Insures save a lot of time and money by processing annual payments over monthly payments. If you can pay a lump sum, you will save money with a discount from your insurer.

- Stop smoking: Why risk your health by smoking? It also dramatically raises your premiums thanks to the fire risk.

- Professional Memberships: Most membership groups like CAA and alumni associations have group insurance for their members. Group rates tend to be lower than individual rates.

5 Elements that will Increase your Home Insurance costs

- Business property: Using your home as your place of business brings increased people on the premises and increased business assets – therefore you may also have an increase in your premium.

- Expensive items: You may need a rider to cover expensive items such as watches, silverware, sporting equipment, and art. Your contents coverage has a maximum and such items could be above the limit.

- Oil-based heating: Oil heating is outdated and risky. Insurers offer lower premiums for more modern heating systems.

- Old house elements: Old, curling shingles? Lead pipes? Not upgrading to safer home elements could increase your premium.

- Roof type: The least reliable roofs are wood shake or shingle, so they cost more to insure. More durable shingles, like metal, can reduce your premium.

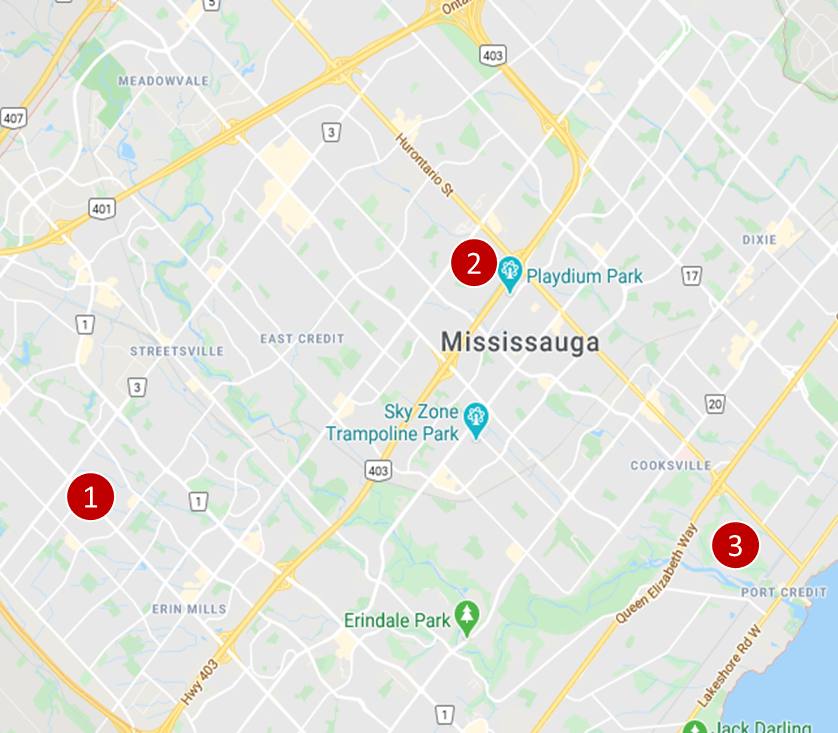

Mississauga Home Insurance quotes, examples

Mississauga home insurance quote #1:

Homeowners insurance for a 2.5-storey detached brick house with a built-in garage for 2 cars. The house is about 1,500 sq. feet and has no basement. The policy is bundled with auto insurance and is located next to the intersection of Winston Churchill Blvd and McDowell Dr.

Price: $53 per month ($636/year)

Mississauga home insurance quote #2:

Homeowners insurance for a 2-bedroom condo in a high rise building, under 1,000 sq. feet. Located on Tuscana Court.

Price: $31 per month ($372/year)

Mississauga home insurance quote #3:

Tenant home insurance for single storey detached house under 1,000 sq. feet with a new roof and a built-in single garage. House has no basement and is located on Wendigo Trail nearby Kenollie Public School:

Price: $24 per month ($288/year)

5 Home Insurance myths to know

Myth #1: Home insurance is mandatory

Home insurance is not mandatory but if you have a mortgage, your lender can make having insurance with them named as an interested party a condition of the loan. Also, landlords can make having contents insurance mandatory. If you own your property free and clear, the choice of home insurance or not is up to you – but it is always advised to have a good policy in place.

Myth #2: Home insurance automatically covers my upgrades

Do not assume that your upgrades are covered. You must first discuss with your insurer how the policy treats upgrades, then inform them when the improvements are done. The policy will have to be updated.

Myth #3: My landlord is responsible for insurance, not me

Your landlord is not responsible for your contents nor your liability. If your dog bit someone, or you flooded the unit and caused damage to the unit below, that is your responsibility. This is why tenant’s insurance is important.

Myth #4: Claims increase my insurance costs

Not always. Some insurers do not penalize for the first claim, while others simply remove the claim free discount.

Myth #5: Home insurance only covers the house

Homeowner’s insurance covers the house, the contents, the structures on the property (sheds, garages, etc.) some living expenses if you must relocate if your house is uninhabitable due to an insured risk, and liability. Condo policies may cover some home improvements and through the main policy or a rider, they may also cover special assessments. Different policies cover different risks so always ensure you know what your policy covers.

Our overview of condo insurance (including quoting) will explain the details of condo insurance coverage.

Home Insurance companies in Mississauga

There are several big P&C (Property and Casualty) / home insurance companies in Mississauga Ontario including

- Intact Insurance

- TD Insurance (owned by TD Bank)

- Aviva

- RSA Insurance

- Economical Insurance (includes Sonnet Insurance)

- Desjardins Insurance

The list of mid-size and small property / home insurance companies in ON is quite long as well:

- Square One Insurance

- RBC Insurance (as Aviva)

- Travelers

- Gore Mutual Insurance

- CAA

- The Co-Operators

- Wawanesa Insurance

- Several others

Home Insurance can be purchased either directly from the insurance companies and their agents, or insurance brokerages / brokers, or through banks if they offer home insurance (e.g. RBC Insurance).

Frequently Asked Questions (FAQ): Home Insurance in Mississauga

How much is Home Insurance in Mississauga?

Home insurance costs in Mississauga depends the type you need. Here is an overview.

- Tenant insurance is the cheapest and it can be as low as $15/month.

- Homeowners insurance for a condo is also quite low since it only covers your contents, liability, and upgrades. Expect to pay around $20-$50/month.

- Homeowners insurance for a house can start at $50/month but go into the hundreds or even thousands based on the home’s size, upgrades, location, environmental risks, and the condition of the property.

What does Home Insurance cover in Mississauga?

What home insurance in Mississauga covers is largely dependent on which type of coverage you choose:

- Tenant insurance: Covers your contents and, in some cases, liability.

- Homeowners condo insurance in Mississauga: Covers the unit, your assigned storage locker, contents, and liability. The building envelope and common areas are not covered by your policy. They are covered by the policy of the condo corporation.

- Homeowners house insurance in Mississauga: This is the most robust coverage. It covers the rebuilding value of the property along with liability and protects against some natural disasters. If not included in the main policy, you can get riders to cover damage from earthquakes, landslides, flooding, etc.

Who has the cheapest Home Insurance in Mississauga?

Insurance premiums for home insurance in Mississauga vary. Some insurers specialize in coverage for seniors or affiliated groups, while others specialize in insurance for certain types of dwellings such as rural properties or condos. To get the cheapest home insurance in Mississauga, we suggest using the services of an insurance broker. Brokers compare the market on your behalf and match you with the policy that best suits your needs. For example, our insurance professionals have access to more than 30 Canadian insurance companies. It does not cost you anything to use the services of a home insurance broker in Mississauga as they are compensated by the insurance companies as a percentage of a policy they sell.

Home Insurance in Mississauga – Reviews: where to find them?

Our proprietary insurance review platform has collected independent consumer reviews for both insurance and financial products since 2012. Click here for free access to thousands of insurance reviews.

Our Publications related to Home Insurance

Introducing a New Tool to Find Out What Issues Canadian Face with Their Insurers

The arrival of COVID-19 has pushed Canadians, more than ever before, online for finding and applying for insurance and banking products. It is not easy, though, to make the right choice without knowing if a particular insurer will be there when you need them the most. As the largest Canadian review platform with thousands of […]

How Much a Good Condo View is Worth Today?

A prospective buyer is always going to be focused on a condo unit’s view. Unlike a house, these units rarely have multiple windows to the outside in various directions. The exterior wall, which usually is either glass or contains a balcony, is likely the only point of contact with the natural world. While the interior […]

Own your home? You could be eligible for these tax credits and rebates

It’s no secret that property prices in many urban areas of Canada are on fire. And it’s not limited to just the core of Toronto and Vancouver. Houses for sale in Hamilton, for example, have doubled in price in the last decade and houses in Mississauga are almost $750,000. It’s increasingly hard for the average […]

How Competitive is it to Buy a Home in Toronto? INFOGRAPHIC

Toronto real estate has been tumultuous in the last few years. At first, everything was going, up, up and up. Record low-interest rates made huge mortgages more attractive, and few new suburbs were developed thanks to the Greenbelt. Almost 90, 000 Newcomers were moving to Toronto each year, along with Canadians from other parts of […]

Canadian Condo Review Platform CondoEssentials Launched

InsurEye Inc has announced the launch of a new website: CondoEssentials. The new site is a condo review platform that has been designed to better inform Canadians about real estate, with a particular emphasis on condominiums. InsurEye has been informing consumers about details of auto, life and condo insurance for years through thousands of independent […]

| Home Insurance in Alberta | Home Insurance in British Columbia | Home Insurance in Manitoba |

| Home Insurance in Ontario | Home Insurance in Saskatchewan | |