Our home insurance guide for St. Catharines provides you with an overview of typical home insurance premiums in Ontario, along with information about how to save on home insurance and other useful tips.

What are typical Home Insurance cost in St. Catharines?

The chart shows average renters and homeowners insurance premiums in St. Catharines, Ontario, and in other provinces. You will see that renters rates are typically lower than homeowners rates. This is due to the differences in coverage. Renters insurance covers contents and sometimes liability. Homeowner’s insurance, on the other hand, covers the dwelling, outbuildings, liability, and contents.

Over the last few years, Ontario has experienced flooding. Most insurers in Canada now cover overland flooding (water entering from outside the home). In some cases, this protection is offered as a rider and is bundled with sewer backup flooding protection. It is a good idea to have insurance to protect against the high cost of overland flooding and sewer backup. Discuss this with your insurer and learn if it is included in your policy, or if a rider is required.

How to save on Home Insurance in St. Catharines: 10 Tips

- New Home Discounts: Your insurer may offer new home discounts. BCAA and Wawanesa are two that provide this perk.

- Water damages: Water damage is an indication of ongoing plumbing or mold issues. Ensure your house inspectors tests behind the walls or ceiling for areas of water damage.

- Pipes: Galvanized and lead pipes are outdated and dangerous. They cost a lot to insure and some companies will not insure them at all. The preferred choice is copper or plastic.

- Wiring: Also on the dangerous side is aluminium or knob and tube wiring. These are fire hazards and no longer used in new builds. A full inspection is required to insure a home with outdated wiring – if insurance is offered at all for this risk.

- Pool: A pool, especially an unfenced one, is a huge red flag for insurers. Expect to pay increased premiums if you own a swimming pool.

- Monitoring: A doorperson, on-site security guard, or alarm system will get you a discount with some insurers. Check your policy to see if this applies.

- Hydrants and fire-stations: Some insurers offer a discount for those located next to a hydrant or fire station.

- Professional Memberships: Some insurers offer discounts or group insurance to members of professional organizations such as CMA or university alumni associations.

- Dependent students: Students living in their own apartment but still dependent on their parents financially may be covered under their parent’s home insurance policy at no extra charge. Not every insurer has this benefit, so check your policy to see if this applies.

- Annual vs. monthly payments: Annual payments mean less time by your insurer spent on filing, mailing, and administering your file. This is why it is always cheaper to pay your premium annually than monthly.

5 Elements that will increase your Home Insurance costs

- Swimming pools: Pools, especially when unfenced, pose a water hazard. Not only is drowning a liability, but a leaking pool could also cause a lot of home or grounds damage.

- Oil-based heating: Any outdating heating system, such as oil, that could start a fire raises your premium.

- Roof type: Metal shingles protect your home from the elements and from fire better than wood shingles. A durable roof helps lower your premium.

- Building frame: Wood frame homes are more flammable than concrete structures. Therefore, wood frame homes cost more to insure.

- Home being a part of your business: When you run a business from home, be it sales, a daycare, or a baking service, you have business assets and more people at your residence. This increases your risk, and your premium.

St. Catharines – Home Insurance quotes, examples

St. Catharines home insurance quote #1:

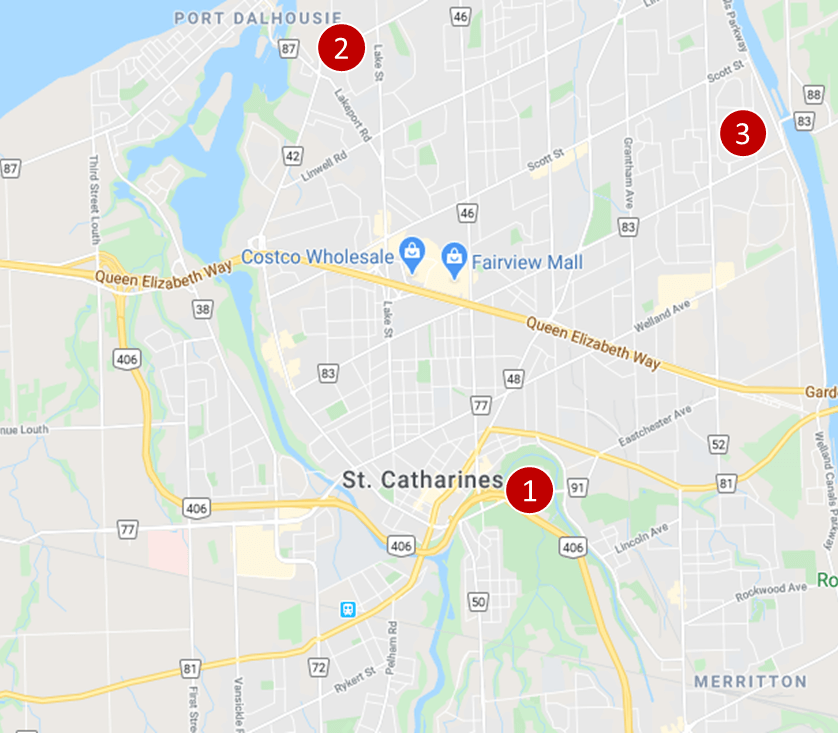

Homeowners insurance for a single storey detached house under 1,000 sq. feet. No basement, vinyl siding, bundled with auto insurance. This house has a new roof and attached garage for one car in the courtyard. Located next to Centennial Gardens.

Price: $44 per month ($528/year)

St. Catharines home insurance quote #2:

Tenant home insurance for a 2-storey townhouse unit. It has a built-in single garage, monitored burglar alarm, and no basement. Located on Lakeshore Rd.

Price: $24 per month ($288/year)

St. Catharines home insurance quote #3:

Homeowners insurance for a 2-bedroom condo in a low-rise brick building located in the Carlton Park neighbourhood on Leaside Dr.

Price: $31 per month ($372/year)

5 Home Insurance myths to know

Myth #1: You must have home insurance

Many are surprised to learn that home insurance is not mandatory – with some caveats. Your lender can require you to have insurance and list them as an interested party and your landlord can require you to have tenant’s insurance. Otherwise, insurance is not actually mandated like auto insurance.

Myth #2: My valuables are covered

Jewellery, collectibles, musical or sporting equipment, wine collections – items like these can be above the contents limit in your policy. Check to see if you need a rider to cover your valuables.

Myth #3: Home insurance pays for required upgrades/maintenance

Normal maintenance and wear and tear on your home is not covered by insurance. Home insurance is for costly unexpected disasters like theft and storm damage, not to replace your worn-out shingles or upgrade old pipes.

Myth #4: It is fine to overstate the value of the damage

If it appears that you are inflating the value of the damage your claim could be denied. Insurance adjusters verify the claims and the costs – wilfully trying to take advantage costs you more in the long run.

Myth #5: If I get in a fight with someone and they sue me, my home insurance will defend me and cover any costs

Liability coverage is only for unexpected or accidental injuries or damage. Starting a fight, intentionally harming someone, or wilfully being negligent (not removing snow and ice from your sidewalk, for example) will not be covered, leaving you a lot of legal and possible medical bills to pay out of pocket.

Frequently Asked Questions (FAQ): Home Insurance in St. Catharines

What does Home Insurance cover in St. Catharines?

Home insurance coverage depends on the type of insurance you choose:

- Tenant insurance: Covers your personal contents and liability.

- Homeowner insurance (condo): Covers the condo unit and associated upgrades (but not the condo building itself), contents (e.g. theft, damage, etc.), and liability.

- Homeowner insurance (house): Covers the entire rebuilding costs for your home, and, depending on your riders, a range of natural impacts (e.g. earthquake, flooding, snow damages, trees and garden, etc.), liability, additional structures on your land (e.g. shed, storage space, etc.).

Who has the best Home Insurance in St. Catharines?

Different home insurance companies specialize on different segments of customers (e.g. seniors, affiliated members of various organizations such as CPA, CAA, etc.), geography, types of buildings, risk types, etc. In order to find the cheapest home insurance, it is important to get a quote from as many insurers as possible and understand what exactly they offer (e.g. level of coverage, deductibles, coverage exclusions, etc.). Our insurance professionals can help you with all these questions.

Home Insurance in St. Catharines – Reviews: where to find them?

Our proprietary insurance review platform has been collected independent consumer reviews for different insurance and financial products since 2012 and has thousands of insurance reviews. Click here to access for free all home insurance reviews.

Our Publications related to Home Insurance

Introducing a New Tool to Find Out What Issues Canadian Face with Their Insurers

The arrival of COVID-19 has pushed Canadians, more than ever before, online for finding and applying for insurance and banking products. It is not easy, though, to make the right choice without knowing if a particular insurer will be there when you need them the most. As the largest Canadian review platform with thousands of […]

How Much a Good Condo View is Worth Today?

A prospective buyer is always going to be focused on a condo unit’s view. Unlike a house, these units rarely have multiple windows to the outside in various directions. The exterior wall, which usually is either glass or contains a balcony, is likely the only point of contact with the natural world. While the interior […]

Own your home? You could be eligible for these tax credits and rebates

It’s no secret that property prices in many urban areas of Canada are on fire. And it’s not limited to just the core of Toronto and Vancouver. Houses for sale in Hamilton, for example, have doubled in price in the last decade and houses in Mississauga are almost $750,000. It’s increasingly hard for the average […]

How Competitive is it to Buy a Home in Toronto? INFOGRAPHIC

Toronto real estate has been tumultuous in the last few years. At first, everything was going, up, up and up. Record low-interest rates made huge mortgages more attractive, and few new suburbs were developed thanks to the Greenbelt. Almost 90, 000 Newcomers were moving to Toronto each year, along with Canadians from other parts of […]

Canadian Condo Review Platform CondoEssentials Launched

InsurEye Inc has announced the launch of a new website: CondoEssentials. The new site is a condo review platform that has been designed to better inform Canadians about real estate, with a particular emphasis on condominiums. InsurEye has been informing consumers about details of auto, life and condo insurance for years through thousands of independent […]

| Home Insurance in Alberta | Home Insurance in British Columbia | Home Insurance in Manitoba |

| Home Insurance in Ontario | Home Insurance in Saskatchewan | |