Welcome to the complete guide to getting the best rates on home insurance in Kamloops. Here you will find average home insurance premiums in British Columbia, myth busting information, and tips on how to choose the best protection for your needs.

What are average Home Insurance cost in Kamloops?

This chart shows average renters and homeowners insurance premiums in British Columbia, in Kamloops, and in other Canadian provinces. Renters insurance rates are lower because they only cover contents and sometimes liability. The dwelling itself is covered by your landlord. On the other hand, if you own the dwelling you are insuring, homeowners insurance rates include the building, the property, some outbuildings like your storage shed, and a number of natural impact factors (storm damage, hail damage, etc.). More coverage can be obtained via riders for things that may not be covered by the main policy, like sewer backup protection.

Homeowners insurance in British Columbia and in Kamloops is higher than many other parts of Canada for the following reasons:

- Earthquakes: British Columbia is at a higher risk of earthquakes. Additional coverage via insurance riders can be purchased for peace of mind. This is especially important for homeowners along the coast.

- High rebuilding costs: British Columbia and Kamloops have a high share of expensive real estate, and this impacts home insurance premiums. Even though rebuilding costs, not the market cost, drive the policy, more expensive homes are simply more expensive to rebuild. Compounding this fact is the building process itself. Homes often take seismic hazards into consideration and are built with special structures and/or lateral bracing supports.

How to save on Home Insurance in Kamloops: 10 Tips

- Change your content coverage: If you rent an apartment or condo, you can often lower your content coverage. There is no need for $250,000 of coverage to protect a laptop and some IKEA furniture!

- Annual vs. monthly payments: When you pay annually instead of monthly, your insurer saves on time and administration costs such as postage, filing, and billing. This is why annual premiums are lower than monthly premiums.

- Renovations: Renovating your house can result in lower home insurance premiums because older and/or poorly maintained homes are riskier (and therefore costlier) to insure. Even if you just renovate the bathroom or kitchen, this may lead to savings on your insurance overall.

- Annual review: Your life, and therefore your insurable needs, change every year. Review your policy annually to see if you can adjust and save, and to ensure you have all the coverage you need.

- Mortgage insurance: Mortgage insurance is a lender product that only covers the cost of the mortgage. It is, in fact, another name for life/critical illness and disability insurance. A term life insurance policy large enough to pay off your outstanding mortgage is usually both cheaper and far more flexible. For example, mortgage insurance is not portable – you lose it and must reapply if you switch banks. Life insurance, however, does not have this drawback.

- Repair instead claims: Before you make that claim, ask yourself if you can you repair the damage. Factor in your deductible and potential rise in premiums before making a claim.

- Claims-free discount: You could be eligible for a discount for remaining claim free. The terms and conditions vary, and not all insurers offer this, so it is worth checking around if you have been claim-free for quite some time.

- Heating: Insurers prefer forced-air gas or electric heat furnaces. Oil heated homes will cost you a lot more in insurance due to their outdated, nature, and the fact that they are not as safe for your home or the environment.

- Water damages: Ask the house inspector to check carefully for signs of water damage, as a history of water damage can cause ongoing issues.

- Anti-theft protection: Some insurers, like The Personal, offer a discount if you have a home alarm system.

5 Elements that will increase your Home Insurance costs

- Old house elements: Having an older home can mean higher insurance costs if elements like the roof or wiring are outdated or poorly maintained. In some cases, you may not be able to obtain insurance until a renovation is completed.

- Aluminum wiring: Aluminum wiring was used in houses prior to 1970 and was discontinued due to being a fire risk. Homeowners insurance for homes with aluminum wiring will either be very expensive and/or very difficult to obtain. In most cases you will be required to get an inspection from a certified electrician.

- Building frame: Since wood frames suffer more damage in a fire, many insurers consider them less safe than concrete or brick homes. Therefore, a wood frame home may cost more to insure.

- Basement: During flooding, a pipe burst, or sewage backup, water always flows down to the lower level – which is why finished basements can drive up your insurance costs. They cost more to repair.

- Working from home: Daycares, bed and breakfasts, and other work-from-home ventures have more people visiting your premises and require you to store work assets on site. This can increase your insurance costs.

Kamloops – Home Insurance quotes, examples

Kamloops home insurance quote #1:

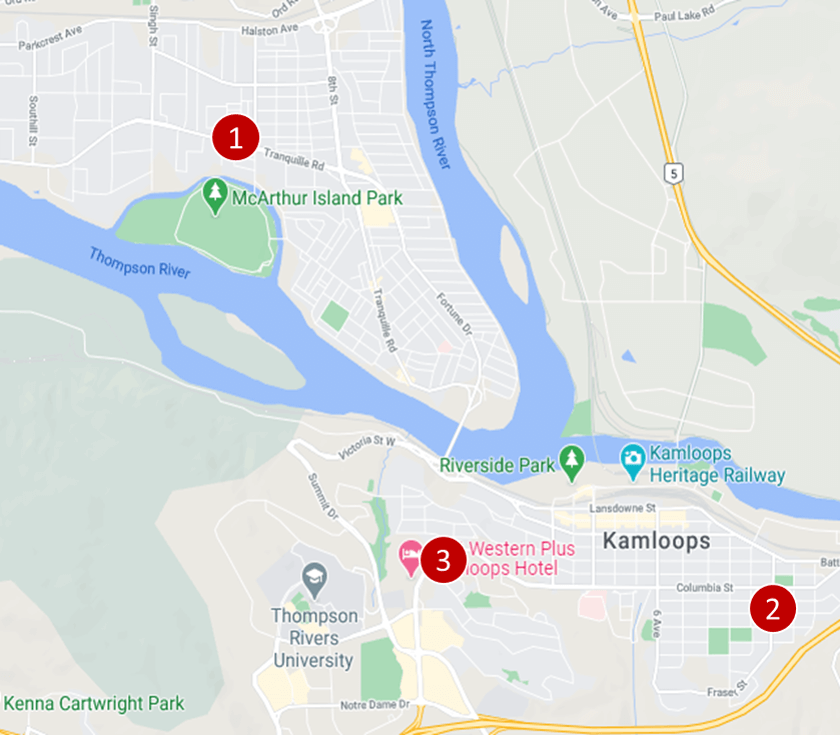

Tenant home insurance for a two-storey townhouse unit, under 1,000 sq. feet. This house has no garage and no basement. It is located on Tranquille Rd next to Norkam Secondary School.

Price: $27 per month ($324/year)

Kamloops home insurance quote #2:

Homeowners insurance for a two-storey detached brick house about 2,500 sq. feet. This is a new house with a built-in garage for two cars, and no basement. The policy is bundled with auto insurance. This home is located on Columbia St., next to Prince Charles Park.

Price: $92 per month ($1,104/year)

Kamloops home insurance quote #3:

Tenant home insurance for a 1.5-storey detached house, under 1,500 sq. feet with no garage or basement. The building is located in West End on Grandview Terrace.

Price: $31 per month ($372/year)

5 Home Insurance myths to know

Myth #1: You must have home insurance.

Unless your lender mandates home insurance (with them listed on the policy to protect their interest in the mortgage) or your landlord asks you to get renters insurance, home insurance is highly advised, but not mandatory.

Myth #2: My home insurance only covers the house

Home insurance covers more than the house and its contents. It also covers structures on the property, living expenses if your home becomes uninhabitable, and personal liability.

Myth #3: Home insurance covers earthquakes

While a few providers, like Square One Insurance, include earthquake insurance in their main policy, in most cases you must purchase a separate earthquake rider. This is important especially for those in British Columbia and Quebec.

Myth #4: If I am a tenant, my landlord’s insurance covers everything – it is their responsibility

Your landlord is not responsible for your personal liability (for example, if you flood the neighbouring unit), nor your contents (against damage and theft). Your landlord may ask you get tenant insurance.

Myth #5: I’m paying for home insurance, so I should make every possible claim under it

Each claim is subject to a deductible; if the loss is less than the value of the deductible, your claim will be denied. If the loss is only slightly higher than the deductible, you lose your claim-free discount. If you make multiple claims, you could be denied renewal or issued a surcharge. Consider all these factors before claiming small losses.

Frequently Asked Questions (FAQ): Home Insurance in Kamloops

What does Home Insurance cover in Kamloops?

Home insurance coverage depends on the type of insurance you choose:

- Tenant insurance: This is designed to cover your personal contents and your liability.

- Homeowner insurance (house): This is very robust coverage designed to cover a variety of risks including the rebuilding costs for your home, liability, structures on your land, some landscaping, and depending on your riders, a range of natural impacts such as flooding, snow damage, etc.

Who has the best Home Insurance in Kamloops, BC?

Insurers specialize in different demographics of consumers. Some work with seniors, others with affiliated membership organizations. Others specialize in building types such as rural or condo. To find the cheapest home insurance, get quotes from as many insurers as possible and compare the coverage, deductibles, exclusions, etc. Our insurance professionals are happy to help you find and understand quotes.

Home Insurance in Kamloops – Reviews: where to find them?

Our proprietary insurance review platform has been collecting independent consumer reviews for a wide variety of insurance and financial products. We have collected thousands of insurance reviews since 2012, and you can click here to access all these home insurance reviews for free.

Our Publications related to Home Insurance

Introducing a New Tool to Find Out What Issues Canadian Face with Their Insurers

The arrival of COVID-19 has pushed Canadians, more than ever before, online for finding and applying for insurance and banking products. It is not easy, though, to make the right choice without knowing if a particular insurer will be there when you need them the most. As the largest Canadian review platform with thousands of […]

How Much a Good Condo View is Worth Today?

A prospective buyer is always going to be focused on a condo unit’s view. Unlike a house, these units rarely have multiple windows to the outside in various directions. The exterior wall, which usually is either glass or contains a balcony, is likely the only point of contact with the natural world. While the interior […]

Own your home? You could be eligible for these tax credits and rebates

It’s no secret that property prices in many urban areas of Canada are on fire. And it’s not limited to just the core of Toronto and Vancouver. Houses for sale in Hamilton, for example, have doubled in price in the last decade and houses in Mississauga are almost $750,000. It’s increasingly hard for the average […]

How Competitive is it to Buy a Home in Toronto? INFOGRAPHIC

Toronto real estate has been tumultuous in the last few years. At first, everything was going, up, up and up. Record low-interest rates made huge mortgages more attractive, and few new suburbs were developed thanks to the Greenbelt. Almost 90, 000 Newcomers were moving to Toronto each year, along with Canadians from other parts of […]

Canadian Condo Review Platform CondoEssentials Launched

InsurEye Inc has announced the launch of a new website: CondoEssentials. The new site is a condo review platform that has been designed to better inform Canadians about real estate, with a particular emphasis on condominiums. InsurEye has been informing consumers about details of auto, life and condo insurance for years through thousands of independent […]

| Home Insurance in Alberta | Home Insurance in British Columbia | Home Insurance in Manitoba |

| Home Insurance in Ontario | Home Insurance in Saskatchewan | |