With help of this home insurance guide for Kingston, Ontario, you will learn about home insurance premiums in Ontario, savings opportunities, and discover a plenty of useful tips for choosing the best policy.

What are average Home Insurance cost in Kingston?

The chart indicates average renters and homeowners insurance premiums in Kingston and across Ontario. Have you noticed in this chart that renters rates are lower than homeowners rates? This is because of the nature of the insurance itself – renters insurance usually covers just contents and sometimes liability. Homeowners insurance, on the other hand, covers the dwelling, the property, liability, and a number of other perils.

Over the past years flooding has become an increasingly pressing issue across Ontario. Most insurers in Canada provide coverage for overland flooding (defined by water entering the home from the outside such as after a flood or rapidly melting snow). However, this coverage may be sold as an additional option (rider) on your policy and/or be bundled with other coverage like sewer backup. As overland flooding coverage is very important to have, we strongly suggest you check with your insurer to see if you are covered, or if you have the option to purchase this coverage as a rider.

Cheap Home Insurance in Kingston: 10 Tips

- Change your content coverage: If you rent an apartment or condo you can lower your contents coverage. Typically, such rentals don’t have valuables equal to the standard $250,000 coverage offered. Lower it if all you are protecting is some IKEA furniture and a couple electronics.

- Water damages: Water damage can be a strong indicator of ongoing maintenance issues. Ensure your inspector checks for signs of water damage, and learn if there has been a history of water damage before you buy a house.

- Decrease liability risk: Take common sense steps to reduce your liability. Fence your pool. Put your dog on a leash. Keep your walkway free of snow and ice.

- Hydrants and fire-stations: Some insurers offer a discount if you live next to a fire hydrant or fire station.

- Professional Memberships: Some insurers, like Meloche Monnex Insurance, offer a discount to members of certain professional organizations. Ask if your alumni association or CPA status, etc., can get you a discount on your insurance.

- Stability of residence: Some insurers, like Grey Power, give you a discount if you have lived in the same residence for a certain number of years.

- Leverage inflation: Many insurers increase your dwelling limit annually to account for inflation. Check your limit to ensure it is realistic and you are not overpaying.

- Bundle: Many insurers offer a discount if you bundle polices, such as home and auto.

- Rebuilding vs. market costs: Consider rebuilding costs when choosing insurance coverage, not the market price of your house. Rebuilding costs are typically lower than market price.

- Benchmark your costs: Costs vary among providers for similar insurance coverage. Use price comparison tools to know how much other companies are charging for similar policies, and check with your peer group to see if these comparisons are similar within your demographic.

5 Elements that will increase your House Insurance costs

- Business property: When your home is also your place of business, expect higher insurance costs. This is to offset the risk presented by increased liability and business assets on site.

- Knob and tube wiring: Outdated and not suitable for today’s high energy consumption levels, knob and tube wiring is strongly disliked by home insurers. If you do find an insurer willing to offer coverage, it will be expensive and you will likely need a full inspection (at your costs). Some may insist that you rewire the house as early as possible.

- Old house elements: Roof systems at the end of their life cycle, old plumbing that needs an upgrade – depending on the age of the house, some elements may push your premium higher. In some cases, insurance may not be offered until renovations are complete.

- Basement: During a flood or pipe burst, water flows down, which is bad news for finished basements. For this reason, finished basements can increase your insurance costs.

- Expensive items: Jewellery, expensive watches, art, wine collections, musical instruments, silverware, furs, sporting equipment and bicycles – the value of luxury items like these may be higher than your contents coverage cap, requiring you to get a separate rider for your expensive goods.

Kingston Home Insurance quotes, examples

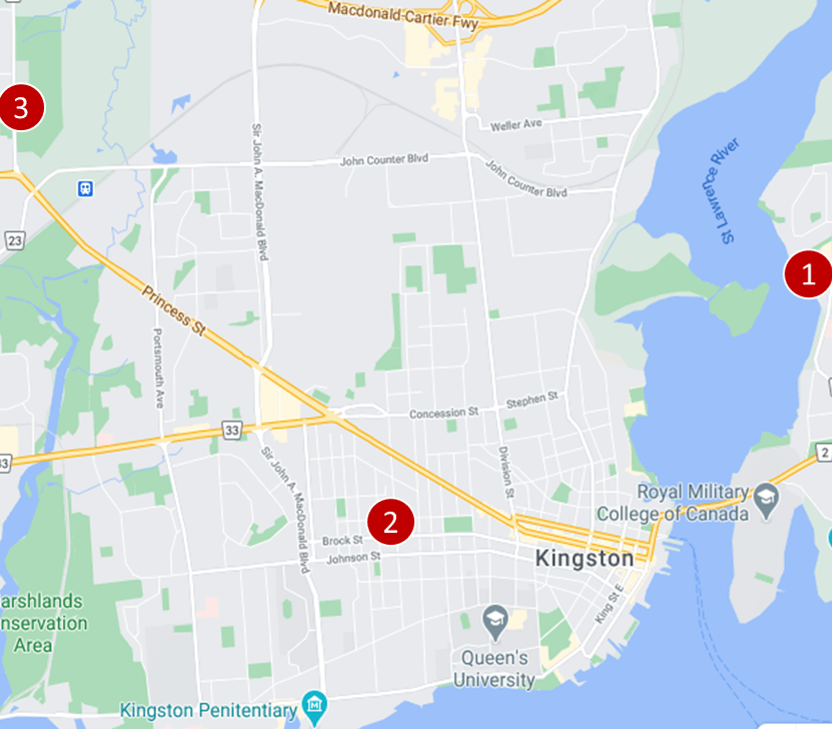

Kingston home insurance quote #1:

Tenants insurance for a two bedroom condo under 1,500 sq. ft, in a high-rise building. Located in Cataraqui River East.

Price: $27 per month ($324/year)

Kingston home insurance quote #2:

Homeowners insurance for a two storey detached house about 1,500 sq. ft. bundled with auto insurance. This home has an attached garage for two cars and a semi-finished basement, located next to Churchill Park.

Price: $79 per month ($948/year)

Kingston home insurance quote #3:

Homeowners insurance for a two-storey unit in a townhouse, under 1,000 sq. ft with a built-in single garage and no basement. The building is located in Cataraqui, next to Trillium Ridge Park:

Price: $82 per month ($984/year)

5 Home Insurance myths to know

Myth #1: If I am away on vacation, my house is covered

You must check your policy to see how vacations are affected by your coverage. Especially during the winter, you may be required to shut off the water and empty the pipes to reduce the risk of a pipe freezing and bursting. You may also be required to maintain the heat. Policies also often dictate how often someone must visit the home, which is typically every 3-7 days. Failure to comply with vacation regulations in your policy could result in a claim denial.

Myth #2: Home insurance pays for required upgrades/maintenance

Home insurance is for perils and risks, not for routine maintenance and renovations. Usual wear and tear are not covered.

Myth #3: Insurance is cheaper for older, less expensive homes

Home insurance is typically more expensive for older homes due to the fact that more things are likely to go wrong. Most older houses also have outdated plumbing, roof systems, heating (such as oil or coal), and wiring (like knob and tube).

Myth #4: If a car is stored in a garage, it is covered by the home insurance policy

Your car in your garage is not covered by your home insurance policy. It is covered by your comprehensive auto insurance policy.

Myth #5: It is fine to overstate the value of the damage

This is a form of fraud that can result in a denial of claim and a cancellation of your policy. Once your policy is cancelled you have ruined your credibility and will have a very hard time getting home insurance elsewhere. Overstating is an easy thing to spot as insurers always conduct an assessment into every claim.

Frequently Asked Questions (FAQ): Home Insurance in Kingston

What does Home Insurance cover in Kingston?

The coverage homeowners can expect in Kingston depends on the type of coverage needed.

- Tenants insurance: Tenants, also known as renters, insurance is designed to cover the unit’s contents, storage locker, and liability.

- Homeowners insurance (house): This coverage is robust and includes the rebuilding value of your home, liability protection, and some protection for natural disasters. Perils, like floods, earthquakes, and landslides can be added via riders if not included in the main policy.

How much is Home Insurance in Kingston?

The cost of homeowners insurance in Kingston depends on a number of factors, including the risk profile of your home and property, and the type of dwelling in which you live.

- Tenant insurance is the cheapest. It can be as low as $20/month.

- Homeowners insurance for a house varies because it depends on many factors. Just some of the factors considered include the size of the home, the location, the risks in the area (flooding, earthquakes, etc.) the condition/maintenance of the home, the type of wiring, and the presence of a fireplace. Homeowners insurance for a house can start at $50/month but go as high as several hundred dollars per month depending on your property.

Remember, you need extra coverage if you have valuables like furs, jewellery, collectables, or business assets in the home, and other factors like the amount of coverage you select, your deductible level, and coverage caps, will also impact the final premium.

Who has the best Home Insurance in Kingston?

The best way to get the cheapest home insurance in Kingston is to compare a variety of quotes from several companies. Different insurers specialize in different segments or demographics. For example, some companies focus on rural properties, others in condos. Some cover seniors or affiliated groups. Our insurance professionals have access to more than 30 Canadian insurance companies and will compare the market on your behalf for free. Contact us to get the best quotes for the coverage you need.

Home Insurance in Kingston – Reviews: where to find them?

Our proprietary insurance review platform has been collecting independent consumer reviews since 2012. Click here for free access to thousands of reviews for a variety of insurance and financial products.

Our Publications related to Home Insurance

Introducing a New Tool to Find Out What Issues Canadian Face with Their Insurers

The arrival of COVID-19 has pushed Canadians, more than ever before, online for finding and applying for insurance and banking products. It is not easy, though, to make the right choice without knowing if a particular insurer will be there when you need them the most. As the largest Canadian review platform with thousands of […]

How Much a Good Condo View is Worth Today?

A prospective buyer is always going to be focused on a condo unit’s view. Unlike a house, these units rarely have multiple windows to the outside in various directions. The exterior wall, which usually is either glass or contains a balcony, is likely the only point of contact with the natural world. While the interior […]

Own your home? You could be eligible for these tax credits and rebates

It’s no secret that property prices in many urban areas of Canada are on fire. And it’s not limited to just the core of Toronto and Vancouver. Houses for sale in Hamilton, for example, have doubled in price in the last decade and houses in Mississauga are almost $750,000. It’s increasingly hard for the average […]

How Competitive is it to Buy a Home in Toronto? INFOGRAPHIC

Toronto real estate has been tumultuous in the last few years. At first, everything was going, up, up and up. Record low-interest rates made huge mortgages more attractive, and few new suburbs were developed thanks to the Greenbelt. Almost 90, 000 Newcomers were moving to Toronto each year, along with Canadians from other parts of […]

Canadian Condo Review Platform CondoEssentials Launched

InsurEye Inc has announced the launch of a new website: CondoEssentials. The new site is a condo review platform that has been designed to better inform Canadians about real estate, with a particular emphasis on condominiums. InsurEye has been informing consumers about details of auto, life and condo insurance for years through thousands of independent […]

| Home Insurance in Alberta | Home Insurance in British Columbia | Home Insurance in Manitoba |

| Home Insurance in Ontario | Home Insurance in Saskatchewan | |