Welcome to your Home Insurance Guide for Nanaimo, BC. This page will give you an idea of Home Insurance Premiums in British Columbia, will inform about savings opportunities and also provide number of other useful tips for choosing Home Insurance protection in Nanaimo.

What are typical Home Insurance premiums in Nanaimo?

This chart illustrates the average Renters and Homeowners Insurance premiums in British Columbia and other provinces including Home Insurance in Nanaimo. Renters insurance rates are typically lower than home owners premiums due to the nature of insurance: Renters insurance typically covers only the content of your rented property and sometimes liability. It does not cover the building itself since it is covered under the insurance property of the homeowner. Overall consumers spend more on Home Insurance in British Columbia because of the several reasons:

Earthquake protection: Seismic activity of the region often results in additional coverage (insurance riders) against earthquakes that customers prefer to purchase to have a peace of mind. It is especially important along the coast.

High rebuilding costs: High share of more expensive real estate indirectly impacts home insurance premiums. Though home insurance is driven by rebuilding costs as opposed to market value of a property, British Columbia has a high share of premium, more expensive properties that are more expensive to rebuild. In addition to that construction of the buildings is sometimes more complicated than in other provinces since these should be build considering seismic hazards (e.g. special structure, lateral bracing requirements)

How to save on Home Insurance in Nanaimo: 10 Tips

- Change your content coverage: If you rent an apartment or condo, you can lower your contents coverage. It’s less likely you’ll own several expensive luxury items, and if you only own some IKEA furniture and a laptop, there’s no need to take out a $250,000 policy!

- Annual review: As your needs change annually, so should your insurance, so ensure you do a yearly review to see if you can save or if you need to adjust your insurance to cover any changes.

- Heating: Your insurer will prefer electric heating or forced-air gas furnaces to oil heating. Oil-heated homes are typically more expensive to insure, so be sure to keep this in mind when looking for a house.

- Wiring: As building specs change over the years, so do the wiring systems installed in homes. Many older homes have aluminum or knob-and-tube wiring, which is more expensive to insure, and some insurers will not cover it at all. Those that do will often demand a full house inspection.

- Pipes: Like wiring, piping systems have gradually changed over the years. Houses built before 1970 are often outfitted with galvanized or lead pipes, but your insurer will prefer copper or plastic plumbing. In your next renovation cycle, keep this in mind, and consider upgrading your plumbing if necessary.

- Neighbourhood: Living in a safer, lower-crime neighbourhood is better for your safety, and will likely lower your premiums.

- Seniors: Many insurers will offer special pricing for seniors.

- Claims-free discount: Not filing claims can be rewarding. If you have been claim-free for some time, consult your insurer about a possible discount. Bear in mind that terms and conditions apply, and not all insurers provide this discount.

- Credit score: Insurance is one of many products with which you can benefit with a discount for good credit. Most companies will use your credit score to calculate your home insurance premium.

- Annual vs. monthly payments: Monthly payments incur higher administrative costs for providers than yearly costs, and some insurers will offer a discount as an incentive to make yearly payments.

5 Elements that will increase your Home Insurance costs

- Home being a part of your business: Your home doubling as your place of business will incur additional risk in the eyes of insurers. Daycares, bed & breakfasts, and clients and suppliers frequenting your home will result in higher insurance costs.

- Oil-based heating: Because oil-based heating brings with it the risk of fire or environmental damage, your insurer will prefer electric heat or forced-air gas furnaces. Some insurers will not cover oil heating at all.

- Building frame: Wooden frames are more fire-prone, and more likely to be structurally compromised in a fire, and as a result, cost more to insure.

- Basement: Finished basements are nice but cost more to insure because they cost more to fix after a flood or other incident.

- Expensive items: Jewelry, heirlooms, expensive art and wine collections, musical instruments, and sports equipment can be above your coverage limit. Luxury items and other costly effects will likely require you to need a separate rider to be covered.

Nanaimo – Home insurance quotes, examples

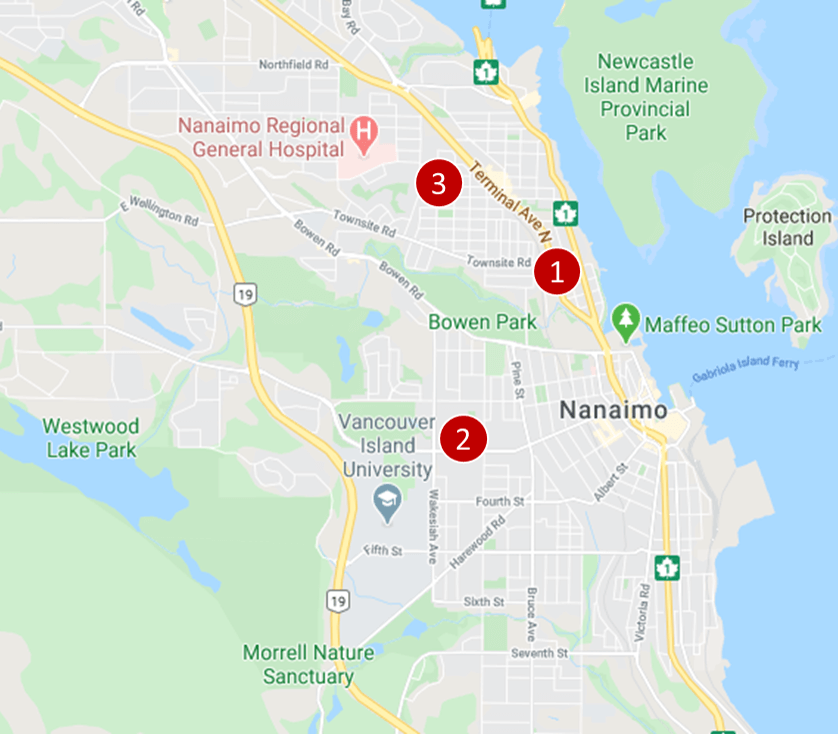

Nanaimo home insurance quote #1:

Homeowners insurance for 2-bedroom condo (low-rise building), located on Cypress St.

Price: $44 per month ($528/year)

Nanaimo home insurance quote #2:

Homeowners insurance for a new 2-storey detached house with an attached single-car garage, no basement, nearly 1,500 sq. feet, located nearby Taylor Place Park.

Price: $69 per month ($828/year)

Nanaimo home insurance quote #3:

Tenant home insurance for a 1-storey detached house, a built-in one-car garage, no basement, a new roof, square footage under 1,000 sq. feet, located on Chelsea St nearby Mansfield Park.

Price: $27 per month ($324/year)

House Insurance Nanaimo, 5 myths to know

Myth #1: You must have home insurance: If you own your home mortgage-free, home insurance – unlike auto insurance – is not mandatory. However, lenders reserve the right to ask you to take out homeowner’s insurance to reduce the risk of theft and liability.

Myth #2: Insurers will substitute the lost/damaged items with new ones.: Not necessarily. Insurers often define payout amounts differently, and it will depend on how this is stipulated in the contract based on actual cash value or replacement value.

Myth #3: Damage from natural disasters or Acts of God are not covered by homeowner’s insurance.: Hail damage, lighting strikes, and other natural disasters are covered by most policies, and other, larger issues such as earthquakes and landslides can be covered by optional riders. An “Act of God” clause does not exist, contrary to popular belief.

Myth #4 Home insurance covers earthquakes.: Some insurance providers like Square One Insurance will include earthquake coverage by default, but most do not. In many cases, you will need to purchase an additional earthquake rider.

Myth #5: Home insurance covers the market value of my house.: Though rebuilding or replacement, and often debris clean-up, are covered in your home insurance, it will not cover the market value of the house which includes land value. For example, in the event that your house burns down, materials and structure are replaced to restore the house to its former state, but not the land.

Frequently Asked Questions (FAQ): Home Insurance in Nanaimo

What does Home Insurance cover in Nanaimo?

Home insurance coverage in Nanaimo (and across Canada) depends on the type of insurance you choose. Here is an overview.

- Tenant’s insurance: Covers liability and personal effects.

- Homeowner insurance (condo): Covers the unit, personal effects, upgrades, and liability. The condo corporation will cover the building envelope and common areas.

- Homeowner insurance (house): Covers rebuilding and replacement costs, personal effects, liability, some property elements, and riders can be added to cover natural disasters (e.g. overland flooding, earthquakes).

Who has the cheapest Home Insurance in Nanaimo?

This will all depend on the provider and the policy. Each provider can specialize in different sets of customer needs. Depending on the provider, they may work with seniors primarily, or membership groups, types of buildings, specific geographic regions, and risk types, among others. Shops around for quotes from as many insurers as possible to learn what each one offers as far as coverage, exclusions, etc. Our insurance professionals will help with your questions and finding quotes.

Home Insurance in Nanaimo – Reviews: where to find them?

We have been collecting independent reviews for different insurance and financial products on our proprietary insurance review platform since 2012. For access to thousands of insurance reviews, click here.

Our Publications related to Home Insurance

Introducing a New Tool to Find Out What Issues Canadian Face with Their Insurers

The arrival of COVID-19 has pushed Canadians, more than ever before, online for finding and applying for insurance and banking products. It is not easy, though, to make the right choice without knowing if a particular insurer will be there when you need them the most. As the largest Canadian review platform with thousands of […]

How Much a Good Condo View is Worth Today?

A prospective buyer is always going to be focused on a condo unit’s view. Unlike a house, these units rarely have multiple windows to the outside in various directions. The exterior wall, which usually is either glass or contains a balcony, is likely the only point of contact with the natural world. While the interior […]

Own your home? You could be eligible for these tax credits and rebates

It’s no secret that property prices in many urban areas of Canada are on fire. And it’s not limited to just the core of Toronto and Vancouver. Houses for sale in Hamilton, for example, have doubled in price in the last decade and houses in Mississauga are almost $750,000. It’s increasingly hard for the average […]

How Competitive is it to Buy a Home in Toronto? INFOGRAPHIC

Toronto real estate has been tumultuous in the last few years. At first, everything was going, up, up and up. Record low-interest rates made huge mortgages more attractive, and few new suburbs were developed thanks to the Greenbelt. Almost 90, 000 Newcomers were moving to Toronto each year, along with Canadians from other parts of […]

Canadian Condo Review Platform CondoEssentials Launched

InsurEye Inc has announced the launch of a new website: CondoEssentials. The new site is a condo review platform that has been designed to better inform Canadians about real estate, with a particular emphasis on condominiums. InsurEye has been informing consumers about details of auto, life and condo insurance for years through thousands of independent […]

| Home Insurance in Alberta | Home Insurance in British Columbia | Home Insurance in Manitoba |

| Home Insurance in Ontario | Home Insurance in Saskatchewan | |