4 Reasons to get a Home Insurance Quote in Ottawa

- Find out if you are overpaying today and start saving

- Request a quote from 10+ insurance providers

- Get home, tenant, house or cottage insurance including flooding coverage

- Talk to a live agent and ask any questions you want

This guide helps you learn about home insurance premiums in Ottawa, along with how to save on your home insurance costs. Our guide also has many other tips on how to choose the best policy and qualify for premium discounts.

What are typical Home Insurance premiums in Ottawa?

This chart shows average renters and homeowners insurance premiums in Ottawa and other locations across Canada. Homeowners insurance is more expensive than renters insurance. This is because of the nature of the insurance – homeowners covers more. Renters insurance only covers contents and liability, while homeowner’s covers the rebuilding cost of the dwelling and the property in addition to liability and some other risks.

People living in Ontario have lower home insurance premiums than Albertans or those in British Columbia due to the lack of Ontario’s seismic activity and wildfires. However, flooding and ice storms have impacted the region in recent years, increasing home insurance premiums as a result.

Flooding is not just the typically covered instances such as pipe bursts. Overland flooding is not usually covered (unless you get a rider). Overland flooding includes flooding from excessive rain, snow melt, overflowing rivers, etc. While some emergency government programs could help with costs, insurance provides the best protection. Discuss overland flooding riders with your insurer today.

Cheap Home Insurance in Ottawa: 10 Tips

- Renovations: Renovating your house can result in lower home insurance premiums because premiums can be higher for older homes if those homes do not have upgraded components like shingles, plumbing, or wiring.

- Change it up: If you have tenant’s insurance and do not have expensive items in your rental, lower the value of the content’s insurance to save money.

- Wood stoves: Wood stoves likely mean an inspection before you will be offered insurance, and higher premiums if you qualify for insurance.

- Pipes: Galvanized and lead pipes are considered extremely risky. Copper or plastic pipes mean cheaper home insurance premiums.

- Water damage: When buying a house, have the inspector check for water damage, as any sign of it on, in, or behind the walls and ceiling can mean a history of water entry problems and/or mold.

- Stop smoking: Smoking is a fire risk and always results in higher premiums.

- Annual vs monthly payments: Annual payments mean less paperwork and processing for the insurer, so they reward you with lower premiums.

- Yearly review: Review your policy once a year. Your needs and risk change over time, so your policy should change to reflect your situation. For example, if you paid off your mortgage you may need lower coverage.

- Bundles: Does your insurer also sell auto and life insurance? If so, ask about a bundle discount.

- Mortgage insurance: Mortgage insurance is a form of life, critical illness, and disability insurance that pays off your outstanding mortgage if the life/lives insured pass away. However, traditional life insurance is cheaper and can even leave some of the benefit left over for beneficiaries. If your life insurance policy is large enough, you may not need mortgage insurance too.

5 Elements that will increase your Home Insurance costs

- Working from Home: Work equipment and inventory in your home can increase your premium due to the risk of lost, stolen, or damaged business property.

- Expensive items: Items like furs, wine collections, fine art, sports or music equipment may not be covered by the limit of your policy. Ask your insurer about a separate rider for expensive or specialized items.

- Knob and tube wiring: Knob and tube wiring is universally disliked by insurance companies because this type of wiring is antiquated and not suited to today’s high energy consumption levels. You may need to re-wire the house or pay extra to obtain coverage.

- Fireplaces and wood stoves: While a beautiful addition to any home, fireplaces and wood stoves increase your fire risk, and therefore increase your premium as well.

- Finished basement: Finished basements are expensive to repair if flooding occurs, so while a finished basement adds to the value of the home, it can also add to your premium.

Ottawa Home Insurance quotes, examples

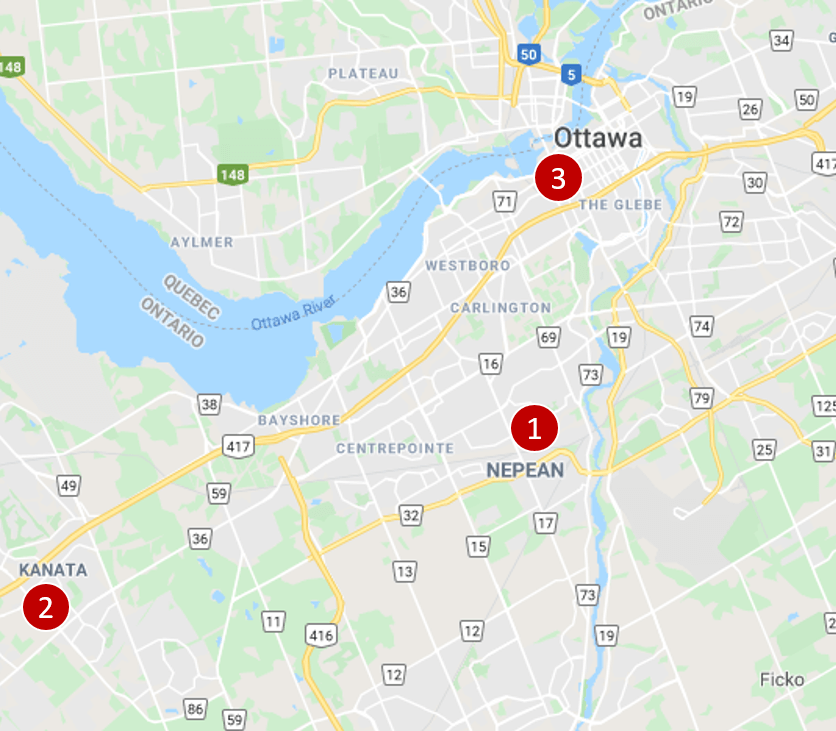

Ottawa home insurance quote #1: Homeowners insurance for a two-storey detached house in Nepean on Withrow Ave. This is a brick home with an attached single-car garage. The home also has a basement and a new roof.

Monthly premiums: $71 per month ($852/year)

Ottawa home insurance quote #2: Tenants insurance for a single storey detached house located in Kanata next to Hayward Park. This is a brick home, under 1,000 square feet, and has an attached single-car garage.

Monthly premiums: $24 per month ($288/year)

Ottawa home insurance quote #3: Homeowners condo insurance for a unit in Center Town on Bay Street.

Monthly premiums: $31 per month ($372/year)

5 Home Insurance myths to know

Myth #1: Home insurance is mandatory

If you outright own your home with no mortgage, you are not obligated to insure it. However, if your home does suffer from an incident, without insurance the entire cost of repair and rebuilding is your responsibility. Lenders have every right to ask homeowners to insure the property and list the lender as an interested party. Landlords can also ask renters to obtain tenant’s insurance.

Myth #2: My house is covered while I’m on vacation

Your policy stipulates the precautions you must take while away. Typically, this involves shutting off the water supply and having someone check on the home periodically. It also means not leaving if major in-progress issues, like basement flooding, are happening. Failure to follow the vacated property requirements usually results in a denied claim.

Myth #3: Home and condo upgrades are automatically covered

You must find out how your policy treats upgrades and add them to the policy. Always inform your insurer of improvements, upgrades, or the purchase of expensive items (art, wine collection, etc.). Do not assume automatic coverage.

Myth #4: My condominium corporation’s insurance covers my condo

Condominium corporation insurance only covers the building envelope and common areas. As a unit owner, you need condo insurance to cover your contents, unit upgrades, and liability.

Myth #5: Claims increase my premiums

Some insurers will not increase your premium for your first claim, or may simply remove your claim-free discount.

5 Differences between Condo and Home Insurance:

When it comes to home insurance, there are a number of differences among various types of policies. Given that Ottawa has several completed and planned condominium projects, it is important to know how condo insurance is different from traditional home or house insurance. Here are five key differences.

1. Policies involved in the coverage

House insurance: A policy on a typical single family home has one component – insurance for the home and property.

Condo insurance: has two components. First is your personal insurance. This covers the interior of your unit and your liability. Second is the commercial condo policy which covers the building envelope and common areas. The condo’s policy does not cover your unit’s interior, contents, or liability, so you need your own separate condo insurance. Condo corporation requirements differ – you may or may not be responsible for clearing your walk; if you are and someone slips on ice you failed to remove, you are liable. Click the link to find out more about the split of responsibilities for condo insurance.

2. Building coverage

House Insurance: Homeowner’s insurance covers your house, contents, and liability. The rebuilding value of the home is covered (not the market value) and riders can be added if other items such as trees and gardens are not covered by the policy.

Condo insurance: Condo insurance has two parts. The condominium corporation is responsible for coverage for the common areas, roof, external windows, parking lot, etc. You are responsible for coverage for your unit’s interior, unit upgrades, and liability.

3. Other structures

House Insurance: Freehold dwellings with several additional buildings like a garage or shed can be covered under your house insurance policy.

Condo insurance: Although condo insurance only covers your unit’s contents and liability, your storage locker is considered part of your unit. If you have a storage locker, be sure to inform your insurer.

4. Claim processing

House Insurance: Although some claims are expensive and lengthy, like a claim for a flooded basement, house insurance claims are straightforward to process. There is only one party and one insurer involved.

Condo insurance: When a condo insurance claim involves both parties – the corporation and the unit owner – the process gets more complicated. For example, if a pipe burst in the wall and your unit is damaged, both insurers come into play.

5. Amount of coverage

House Insurance: Your house insurance covers the building, contents, house upgrades, some aspects of the property, and liability. Remember, however, that the rebuilding value of the home, not the market value, is covered. Coverage typically includes debris clean up in the case of a fire, hailstorm, etc.

Condo insurance: Coverage limits are lower for condos because only the contents and liability are insured, not the physical condo building (which is insured by the condo corporation).

Coverage for homeowners insurance in Ottawa depends on the type of insurance you need.

- Tenants insurance: Tenant’s, also known as renter’s, insurance covers your unit’s contents, storage locker, and liability.

- Homeowners condo insurance: The building envelope and common areas are the responsibility of the condo corporation. Your condo insurance covers the unit, storage locker, contents, and liability.

- Homeowners insurance (house): Robust coverage that includes the rebuilding value of your home along with liability and some protection for natural disasters (other disasters like floods, earthquakes, and landslides can be added via riders if not included).

The cost of homeowners insurance in Ottawa depends on the risk profile of your home and property, and the type of dwelling in which you live.

- Tenant insurance is the cheapest. For a condo, it can be as little as $15/month.

- Homeowners insurance for a condo is not very expensive because it only covers your condo unit (your upgrades, contents, liability). This type of coverage is around $20-$50/month.

- Homeowners insurance for a house varies because it depends on many factors like the size of the home, the location, the risks in the area (flooding, earthquakes, etc.) the condition/maintenance of the home, the type of wiring, the presence of a fire place and more.

Since different insurers specialize in different demographics, the best way to get the cheapest home insurance in Ottawa is to compare a variety of quotes from several companies. Some companies focus on rural properties, others in condos. Some cover seniors or affiliated groups. Our insurance professionals have access to more than 30 Canadian insurance companies and will, for free, compare the market on your behalf and present you with the best quotes for the coverage you need.

Our proprietary insurance review platform has been collecting independent consumer reviews since 2012 for all types of insurance and financial products. Click here for free access to thousands of reviews.

Our Publications related to Home Insurance

Introducing a New Tool to Find Out What Issues Canadian Face with Their Insurers

The arrival of COVID-19 has pushed Canadians, more than ever before, online for finding and applying for insurance and banking products. It is not easy, though, to make the right choice without knowing if a particular insurer will be there when you need them the most. As the largest Canadian review platform with thousands of […]

How Much a Good Condo View is Worth Today?

A prospective buyer is always going to be focused on a condo unit’s view. Unlike a house, these units rarely have multiple windows to the outside in various directions. The exterior wall, which usually is either glass or contains a balcony, is likely the only point of contact with the natural world. While the interior […]

Own your home? You could be eligible for these tax credits and rebates

It’s no secret that property prices in many urban areas of Canada are on fire. And it’s not limited to just the core of Toronto and Vancouver. Houses for sale in Hamilton, for example, have doubled in price in the last decade and houses in Mississauga are almost $750,000. It’s increasingly hard for the average […]

How Competitive is it to Buy a Home in Toronto? INFOGRAPHIC

Toronto real estate has been tumultuous in the last few years. At first, everything was going, up, up and up. Record low-interest rates made huge mortgages more attractive, and few new suburbs were developed thanks to the Greenbelt. Almost 90, 000 Newcomers were moving to Toronto each year, along with Canadians from other parts of […]

Canadian Condo Review Platform CondoEssentials Launched

InsurEye Inc has announced the launch of a new website: CondoEssentials. The new site is a condo review platform that has been designed to better inform Canadians about real estate, with a particular emphasis on condominiums. InsurEye has been informing consumers about details of auto, life and condo insurance for years through thousands of independent […]

| Home Insurance in Alberta | Home Insurance in British Columbia | Home Insurance in Manitoba |

| Home Insurance in Ontario | Home Insurance in Saskatchewan | |