Get a free Auto Insurance quote from 20+ Canadian insurers

Here you can download this infographic as a PDF.

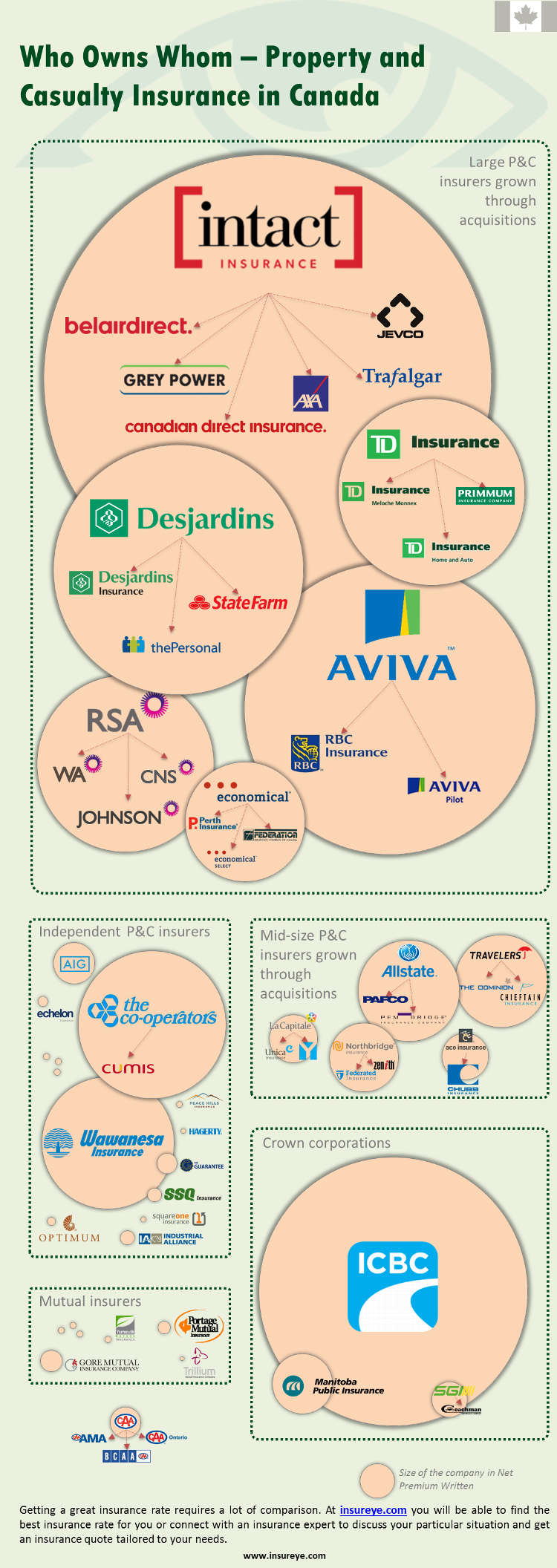

The variety of insurance companies in Canada is not what it appears to be in the Canadian market. From a consumer perspective there are almost a hundred different insurance companies, but the reality is a bit different:

- Many companies are owned by other larger insurers and while they operate under their own brand, they are not truly independent. Being owned by a larger company often means fulfilling a set directive in terms of revenue, savings and operations. This directive may impact customer and claims service.

- In several provinces (BC, SK, MB) basic and mandatory auto insurance is provided by one insurer, while only top-up products can be purchased from other providers.

As we analyzed Property and Casualty (Home and Auto) insurance companies in Canada, we identified the following groups of insurers:

Group # 1: Large P&C Insurers Grown Through Acquisitions

These are huge companies that acquired other smaller insurers over time. The most prominent example is Intact with such brands as Intact (including Belairdirect, Grey Power, Canadian Direct Insurance, AXA, Jevco Insurance and Trafalgar Insurance).

Other examples of companies that fall into this category are Aviva (including RBC General Insurance), RSA (including Western Assurance, CNS and Johnson Insurance) , TD Insurance (including TD Meloche Monnex and Primmum), Desjardins Insurance (including State Farm and The Personal), and Economical Insurance (including Perth Insurance and Federation Insurance).

A recent large acquisitions was the RBC Insurance sale to Aviva for $582-million dollars.

Group #2: Mid-size P&C Insurers Grown Through Acquisitions

This group is similar to the previous one; the difference being that these are smaller insurance companies. Insurers in this category are Allstate (including Pafco and Pembridge), Northbridge Financial (with Federated Insurance and Zenith Insurance), La Capitale (with Unica Insurance and York Fire and Casualty Insurance), Travelers (with Dominion and Chieftain Insurance) and Ace Insurance (with Chubb Insurance)

Group #3: Independent P&C Insurers

These are companies that are still independent and operating under their own brand, not the brand of a parent company. Their size can vary. Examples of two larger companies are Wawanesa Insurance and The Co-Operators. There are numerous smaller P&C insurers such as Echelon, Peace Hills Insurance, Hagerty (focusing on classic cars), The Guarantee, SSQ Insurance, Square One Insurance (focusing on home insurance and offering extensive online services), Industrial Alliance, Optimum, AIG and others.

Some of them are focused on particular regions, such as e.g. Peace Hills Insurance. Some are backed up by larger financial organizations, such as SSQ Insurance and Genworth Financial, who also offer life insurance and other financial/banking products.

Group #4: Crown Corporations

As mentioned earlier, in three Canadian provinces basic auto insurance is offered by one company and other insurers can only offer additional (optional) car insurance benefits. These crown corporations are ICBC (Insurance Corporation of British Columbia) in British Columbia, MPI (Manitoba Public Insurance) in Manitoba, and SGI (Saskatchewan Government Insurance) in Saskatchewan.

Group #5: Mutual Insurers

These are single insurance companies that are jointly owned by their policyholders. The key difference of these insurers is that any profit earned by these companies is distributed back to the policyholders either as dividends or in the form of reduced insurance rates. Examples of such companies are Gore Mutual Insurance, Trillum Mutual Insurance and Yarmouth Mutual.

Interested in Auto Insurance?

Get a free, no-obligation quote

We compare rates from over 20 insurers to show you 3 best quotes

We hope that you have found this overview and the infographic helpful and learned about car insurance companies in Canada. We also thank Adam Mitchell from Mitchell & Whale Insurance Brokers for his insight about P&C market in Canada. Please, consider that the insurance landscape is constantly changing and therefore, this picture can constantly evolve.

Searching for an overview of Life Insurance Companies in Canada?

Source of insurance premiums data: Canadian Underwriter